See Risks and Disclosures for more information regarding net-of-fees performance.

Wespath Benefits and Investments (“Wespath”) is a general agency of The United Methodist Church, a 501(c)(3) tax-exempt organization. Wespath administers benefit plans and together with its subsidiaries, UMC Benefit Board, Inc. (“UMCBB”) and Wespath Institutional Investments, LLC (“WII”) invests (or provides back-office services for) assets on behalf of benefit plan participants and beneficiaries, plan sponsors and other institutions controlled by, affiliated with or related to The United Methodist Church (the “Church”). For GIPS compliance purposes, the Firm referenced herein is defined to include Wespath, UMCBB and WII (“Firm”). Wespath claims compliance with the Global Investment Performance Standards (GIPS®). GIPS is a registered trademark of CFA Institute. CFA Institute does not endorse or promote this organization, nor does it warrant the accuracy or quality of the content contained herein. To obtain a copy of Wespath’s GIPS Report, please call us at 1-847-866-4100 or e-mail us at [email protected].

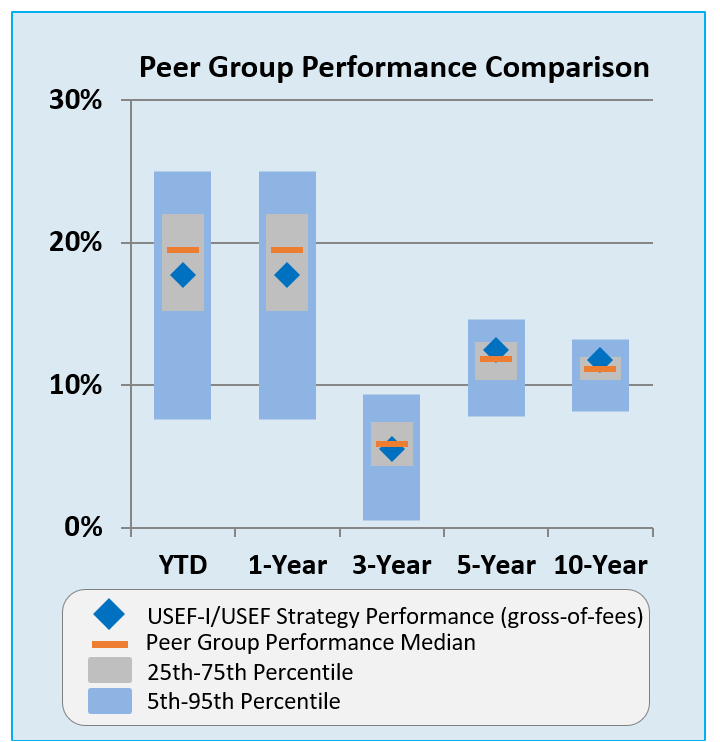

1 The performance shown is for the stated time period only and computed in U.S. Dollars (USD). Historical returns are not indicative of future performance. Investment performance is presented net-of-fees—that is, with the deduction of external investment management fees, custody fees, and administrative and overhead expenses. The investments of the funds and composites may vary substantially from those in the applicable benchmark. The benchmarks are based on broad-based securities market indices, which are unmanaged, cannot be invested in and are not subject to fees and expenses typically associated with investment funds. Investments cannot be made directly in an index. This chart was produced using data from sources believed to be accurate. The bar chart and table assume reinvestment of distributions.

2 Please refer to the Investment Funds Description - I Series for more information about each Fund. This information is for informational purposes only and is not an offer to purchase securities. The investment funds are neither insured nor guaranteed by the government.

3 Benchmark descriptions can be found here.

4 The performance presented reflects the historical performance record of the composite employed by: (a) Wespath Institutional Investments (WII) through funds called the I Series funds available as of January 1, 2019; and (2) UMC Benefit Board, Inc.an affiliated entity, through funds called the P Series funds and available to certain Institutional Investors (as defined below) prior to January 1, 2019. The composite includes the applicable P Series fund before January 1, 2019. After January 1, 2019 the composite includes both the applicable P Series fund and I Series fund (asset-weighted). The composite for the applicable P Series fund and I Series fund have substantially similar investment objectives and investment strategies and are referred to collectively as “the Composite.” The P Series funds are not available to Institutional Investors other than in exceptional circumstances agreed to by the P Series funds adviser.

Historical returns are not indicative of future performance. Returns presented are time‐weighted returns. Net returns are presented net of actual fees and expenses, including transaction costs, custody fees, sub‐advisory fees, and administrative/overhead expenses and are net of withholding taxes. The portfolios in the Composite do not pay any investment management fees to Wespath. Administrative/overhead expenses are paid by the portfolios in the Composite to Wespath.

Units of the I Series funds are available to organizations related to the Church and organized and operated exclusively for religious, educational, benevolent, fraternal, charitable, or reformatory purpose: (1) no part of the net earnings of which inures to the benefit of any private shareholder or individual; or (2) which is or maintains certain pooled income funds, collective trust funds, collective investment vehicles or similar funds for the collective investment and reinvestment of assets of certain designated vehicles available for charitable investments. All such organizations shall qualify as permissible investors in a fund excepted from the definition of “investment company” contained in Section 3(c) (10) of the Investment Company Act of 1940, as amended (and are referred to as “Institutional Investors”). Certain, but not all, Institutional Investors were eligible to invest in the P Series prior to January 1, 2019.