By: Connie Christian, CFA

(Manager, Fixed Income)

February 9, 2026

Compared to a few years ago, fixed income once again looks like a valuable source of diversification for investors. In the low-coupon world of the last decade, bonds offered little income and meaningful downside risk when rates moved higher. Today, the math is different. Coupons are meaningfully higher, and bonds have a much better ability to cushion portfolios during periods of volatility.

This reset has restored one of fixed income’s core roles: providing balance. When growth slows or risk assets struggle, bonds with reasonable yields can stabilize returns and generate income. That combination of income plus downside protection is more pronounced now compared to the recent past, offering more meaningful risk reducing characteristics in a balanced portfolio.

A slower growth environment also plays to fixed income’s strengths. After years of above-trend growth, fueled by fiscal stimulus, pent-up demand and low interest rates, the global economy is decelerating. Slower but still-positive growth tends to reduce inflation pressure over time and increases the likelihood that central banks are closer to the end of tightening cycles than the beginning. Even if policy rates stay “higher for longer,” they are unlikely to rise indefinitely. That asymmetry matters. When economic growth cools, fixed income benefits from stable or falling rates, tighter financial conditions that reward quality, and a renewed focus on cash flow rather than capital appreciation.

Importantly, today’s opportunity set is not limited to government bonds. Credit markets now offer yields that compensate investors for taking selective risk, especially when balance sheets are still generally healthy and defaults remain contained. Plus, the income provided by bonds provides a cushion which reduces reliance on precise predictions about interest rate movements. In a slower growth world, that steady income stream becomes increasingly valuable.

For starters, active management is usually advantageous in fixed income. Bond benchmarks are typically constructed so that the most indebted issuers have the largest weights. Thus, simply hugging the benchmark via passive management means owning a portfolio that is, by definition, heavily exposed to leverage.

On the other hand, active management allows investors to be selective, tilting toward quality and liquidity, avoiding excess leverage, and deliberately positioning to protect capital while generating income. Active managers can use a broad toolkit: adjusting duration and curve exposure, focusing on issuer balance sheet quality, and finding relative value across sectors and regions. They can also manage downside risk intentionally rather than inheriting it through an index, which is an advantage in a market where monetary policy uncertainty is elevated.

For example, Wespath’s actively managed fixed income fund for institutional investors, the Fixed Income Fund – I Series (FIF-I), has taken advantage of the tools described above and found opportunities in the market. In 2025, the fund generated an 8.42% return, net of fees, outperforming its benchmark’s return of 7.34%. Over three years, the fund has generated an annualized return of 6.34%, outpacing its benchmark by 0.99%, and over five years, the fund returned an annualized 0.73%, outperforming its benchmark by 0.69%.1

These results highlight how blending complementary active management styles and strategies in fixed income can add meaningful value over a broad market index. They also highlight how Wespath’s investment philosophy, which emphasizes thoughtful incorporation of best-in-class investment strategies, manifests itself in the fixed income asset class and supports the nonprofit organizations we serve.

Another core tenant of Wespath’s investment philosophy—purposeful diversification—is relevant in today’s environment, as fixed income looks to remind investors about its critical role in a multi-asset portfolio.

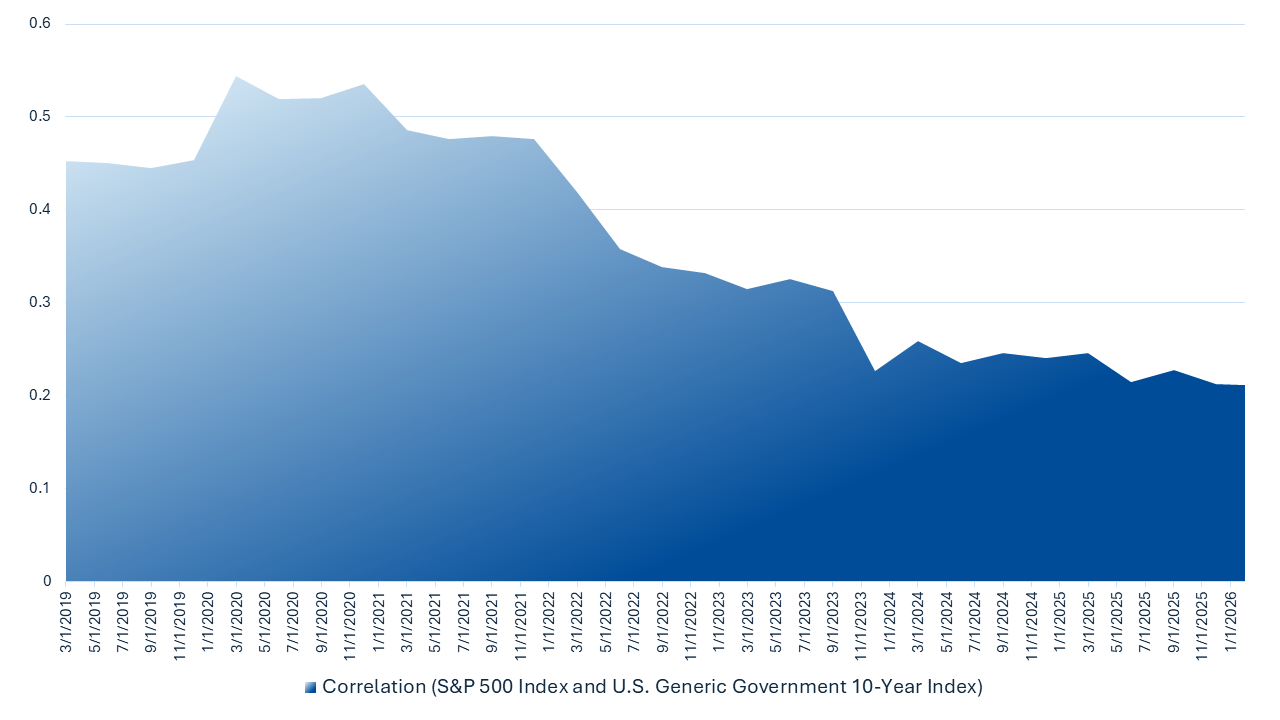

For example, with inflation well off its 2021-2022 highs, the correlation between bonds and equities has begun to normalize, restoring fixed income’s diversification benefit. In fact, the correlation between 10-year U.S. Treasuries and the S&P 500 Index, as shown in the chart below, has been declining for several years:

A lower correlation between stocks and bonds is beneficial for the purposes of diversification, as bonds often serve to reduce risk and provide stability during volatile periods for equities. If in practice stocks and bonds move higher and lower at the same time, this core purpose becomes muted. Correlation peaking during 2020 and 2021 is no coincidence: When there is higher unexpected inflation, interest rates increase and bond prices decrease, and at the same time, rising costs erode corporate profits and put downward pressure on equity valuations. Thus, cooling inflation has helped usher in a return to normalcy in the correlation between stocks and bonds.

Said differently, investors seeking diversification have choices again. Organizations with lower risk tolerance or pools of capital that require more stability no longer need to reach far out on the risk curve to generate income. High-quality bonds can once again do what they are meant to do: provide income, preserve capital and diversify equity risk.

That said, fixed income investing is not without risks. Increased fiscal spending is a meaningful concern, particularly in developed markets where debt levels are already high. Larger deficits can put upward pressure on long-term yields and increase volatility in government bond markets. Geopolitical risks remain elevated, from ongoing conflicts to trade tensions and supply chain realignments, all of which can introduce inflation shocks or sudden risk-off episodes. But these risks argue for humility, diversification and active oversight, not for avoiding fixed income altogether.

Additionally, Wespath’s investment process is designed to help mitigate these risks through disciplined and repeatable oversight. We emphasize purposeful diversification not just across asset classes, but also across sectors, strategies and managers, when investing in fixed income.

Meanwhile, thorough due diligence seeks to evaluate whether underlying managers have the skill, process and resources to deliver on their stated objectives. Clear guardrails help keep the overall fund aligned with its intended structure, while well-defined guidelines and risk controls provide Wespath’s investment managers with the tools and boundaries needed to manage portfolios prudently. Together, these elements create a framework that empowers resilience across a range of market environments and is well suited to support the missions of nonprofit institutional investors.

In today’s environment, fixed income is a meaningful source of income, diversification and potential return for institutional investors. The reset in yields has changed the equation: Higher coupons provide more income, slower growth supports bond fundamentals, and active management offers a way to navigate a more complex landscape. While risks remain, fixed income deserves a place in portfolios, not as an afterthought, but as a deliberate, forward-looking allocation.

Bond Coupon: The annual interest payment made to bondholders. It is a fixed payment that is made from the bond’s issue date until maturity. The bond coupon is calculated as a percentage of the bond's face value, known as the coupon rate. For example, a bond with a 5% coupon rate and a $1,000 face value pays $50 annually, typically split into semiannual payments.

Bond Prices and Interest Rates: Bond prices and interest rates have an inverse relationship. When interest rates rise, bond prices usually fall, and vice versa. Consider that if interest rates fall, existing bonds with a fixed income rate become more attractive than new bonds. Demand for existing bonds will go up, and their price will increase. If interest rates rise, investors won't want the existing bonds with a lower fixed interest rate: Prices for existing bonds will decline until their yield matches that of new bond issues.

Downside: A negative movement in the price of securities, sectors, or markets.

Downside Protection: Investors can seek to protect their portfolios against a downside by employing different strategies, including diversification. A downside protection is a safety net of sorts if an investment starts to fall in value.

Duration: Measures the sensitivity of an asset’s price to changes in interest rates. Specifically, duration measures the percentage price change in a bond for a 100 basis point (one percentage point) move in interest rates, assuming an equal shift in all rates across the yield curve. Duration is generally also a measure of the weighted time until receipt of an asset’s future cash flows.

Fixed Income or Bond: A classification of securities that represents an obligation to make periodic payments in the form of interest and to return the original amount invested (also known as the “principal”) at a future specified date, also known as the “maturity date.”

Risk-On Risk Off: Risk-on risk-off investing describes how changes in investor risk tolerance influence market activity, impacting asset prices and investment decisions. In risk-on environments, investors favor higher-risk investments as market conditions appear favorable. Conversely, risk-off environments drive investors toward lower-risk assets during periods of uncertainty.

Yield: The value of annual interest or dividend payments from an investment, usually stated as a percentage of the investment price.

Yield Curve: A graphical depiction of the market yield of comparable fixed income securities—usually U.S. Treasury securities—across a range of available maturity dates.

Note: Some of the glossary terms were developed by Investopedia.

Subscribe Now!

Interested in more investment content? Be the first to receive our free resources—newsletters, webinars, and updates from our team and industry leaders—designed to help you stay informed and inspired.

Subscribe Now!Ready to Connect with Wespath?

Wespath provides OCIO services and investment management solutions to faith-based organizations, churches and other mission-driven nonprofits. If your organization needs help with policies, endowments or values-aligned investing, we’re here to help.

Contact Us!

1 FIF-I’s benchmark is a blended benchmark consisting of the Bloomberg U.S. Aggregate Index, effective July 1, 2025, and prior to that, the Bloomberg U.S. Universal Index (excluding mortgage-backed securities). Historical returns are not indicative of future performance. Fund returns are net of fees. Please refer to the Investment Funds Description – I Series for more information about the funds, including fees and expenses. This is not an offer to purchase securities.

We have updated our website with a new look and made it simple to navigate on any device.

We will continue to add more valuable information and features. Please let us know how we are doing.

P.S. For plan sponsors and plan participants, we have a new look for you too. Check out the Wespath Benefits and Investments website.