By Piotr Chwala

Manager, Private Markets

November 27, 2023

Investing in fixed income assets like bonds is a very popular strategy that is often considered a relative safe haven for investors. But the market has been quite volatile in recent years, and this strategy looks a lot different today compared to the low interest rate environment seen just a few years ago. Many investors are understandably reevaluating their approach to bonds right now, weighing both their risks and their historic opportunities.

With all this in mind, members of the Wespath team have developed a three-part series on bond investing to share their thoughts on fixed income opportunities and how Wespath approaches these types of investments!

The first part of the series, “Exploring the Fixed Income Market,” is available here.

Earlier this month, my colleague Connie wrote an informative piece about fixed income investments in today’s context of sharp interest rate hikes and yields that are eclipsing multi-year highs. Today, we’ll add to that conversation with a closer look at an alternative source of diversification to traditional fixed income: private credit.

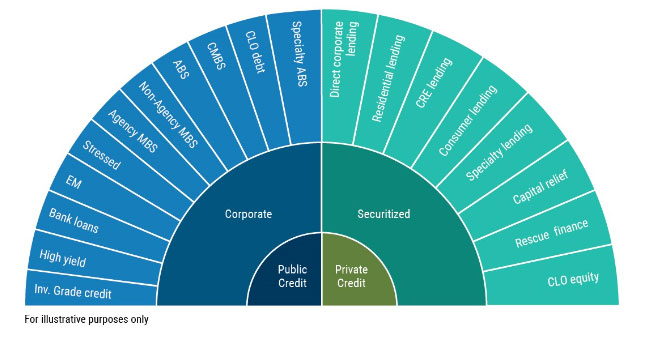

Private credit consists of firms and dedicated investment vehicles that directly lend money to private companies or on assets such as real estate. These investments are more illiquid than public credit and are not traded on the public markets. The spectrum of private credit investments is wide and illustrated by the visual below.

Spectrum of Public and Private Credit

Source: PIMCO

Source: PIMCO

Global Financial Crisis Created Private Credit Opportunities

Private credit has experienced strong growth since the Great Recession in 2008. Regulatory changes following the crisis increased the minimum size of public debt market issuances and reduced the amounts that banks can lend, creating a market opportunity for private credit managers.1

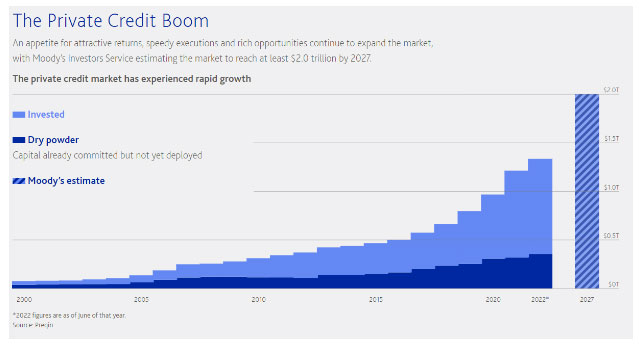

Lending opportunities have evolved throughout various market cycles. More recently, banks have pulled back on lending due to high funding costs and increased regulatory pressures following the bank turmoil experienced in early 2023. This is creating additional opportunities for direct lending by private credit lenders but other opportunities within private credit are also emerging. According to Moody’s Investors Service, the sector is expected to continue to grow, reaching an estimated $2 trillion by 2027.

Source: Moodys

Source: Moodys

Private credit investments provide lenders and borrowers flexibility on terms, including the ability for lenders to ensure there is transparency and alignment of interests. This flexibility can also be utilized to provide private credit managers additional options to preserve value. For example, protective covenants (clauses in a lending agreement) are designed to limit a borrower’s excess risk-taking and encourage good governance.

These structural features have contributed to lower credit loss rates on direct lending loans. The Cliffwater Direct Lending Index (U.S. direct lending index) reports a 10-year credit loss rate through 2022 of 0.90%, which compares to rate of 1.47% for the Bloomberg U.S. High Yield Index.2

Wespath’s Perspective on Private Credit

Wespath has invested in private credit since 2010. Currently, the Fixed Income Fund – P Series (for participants and annual conferences) and Fixed Income Fund – I Series (for institutional investors) include exposure to private credit. There are a number of reasons why we feel private credit is additive to our diversified fixed income funds:

Conversations with several of our private credit managers confirm excitement about the circumstances facing the industry right now. Just as Connie mentioned, higher yields are creating a compelling moment for lending overall, and within private credit specifically, managers are excited about the ability to provide flexible capital solutions in a constrained lending environment.

This is creating some unique opportunities for experienced asset management firms. For example, through both the Fixed Income Fund – P Series and Fixed Income Fund – I Series, Wespath3 recently committed capital to a manager providing private capital solutions to companies focused on renewable energy and climate change solutions. This strategy will target companies with established business models, strong cashflows and proven technologies that will benefit from the global energy transition. Separately, Wespath recently approved a recommitment to a commercial real estate private debt fund focused on capital preservation and current income generation. Investments in this fund will be concentrated in high conviction sectors including residential and logistics.

As we can see, decades-high yields and the unique specializations of private credit are leading to interesting opportunities for investors like Wespath.

Johara Farhadieh, deputy chief investment officer, contributed to this post.

1 Keenan, 2022 (BlackRock Private Credit: Evolution and Opportunity in Direct Lending)

2 https://cliffwater.com/files/cdli/docs/Cliffwater_Report_on_US_DirectLending.pdf

3 Wespath Benefits and Investments (“Wespath”) is a general agency of The United Methodist Church, a 501(c)(3) tax-exempt organization. Wespath administers benefit plans and together with its subsidiaries, UMC Benefit Board, Inc. (“UMCBB”) and Wespath Institutional Investments, LLC (“WII”) invests (or provides back-office services for) assets on behalf of benefit plan participants and beneficiaries, plan sponsors and other institutions controlled by, affiliated with or related to The United Methodist Church (the “Church”).

We have updated our website with a new look and made it simple to navigate on any device.

We will continue to add more valuable information and features. Please let us know how we are doing.

P.S. For plan sponsors and plan participants, we have a new look for you too. Check out the Wespath Benefits and Investments website.