By Evan Witkowski

Manager, Institutional Relationships

September 11, 2023

Here at Wespath, we partner with many different types of Methodist organizations—from foundations and children’s homes to senior living facilities, higher education institutions and more. In addition to sharing our Methodist roots, all these groups have the common connection of being not-for-profit, mission-focused organizations, meaning they all understand the opportunities and challenges facing charitable bodies right now.

Recently, Ken Sloane—director of Stewardship & Generosity at fellow United Methodist agency Discipleship Ministries—wrote an excellent piece about recent trends in the world of charity: 5 Factors That Affected Your Church’s Income in 2022. Ken’s article references data from GivingUSA, which publishes a comprehensive report that summarizes how people in the U.S. gave to charity throughout the year, including what kinds of organizations received funds and how much.

As Ken points out, it’s an interesting time for donations to churches, as covered by GivingUSA’s “Religion” category. But as I said, Wespath’s partners cover a wide swath of the not-for-profit landscape—while we are all faith-based, it’s likely that some of our clients experience the trends of other types of organizations covered by this data as well.

With that in mind, let’s take a closer look at the GivingUSA data—and other recent trends relevant to not-for-profit organizations—to see what might be impacting giving trends for Wespath’s institutional investors.

Factor #1: Americans Gave Less

Ken’s article highlights one of the GivingUSA report’s key takeaways: total giving was down last year (to the tune of a 10.5% inflation-adjusted decline from 2021). I can’t help but think of Morgan Housel’s quote, “Planning is important, but the most important part of every plan is planning on your plan not going according to plan.” All charitable organizations depend on a stream of giving to empower their mission, and this downward trend makes it increasingly difficult for them to fulfill current needs and plan ahead.

We can speculate that high inflation, fear of a recession and declining financial markets all contributed to this giving decline in 2022. But there are reasons to be optimistic. Inflation has continued to cool, and markets have rebounded so far this year. While we don’t yet know how long that positivity will last, it’s a much-needed reprieve from the volatility of last year. There are also good signs for the organizations Wespath serves—while total giving was down in 2022, giving to the “Foundation” category increased, while giving to the “Religion” category declined only modestly.

Likewise, giving by bequests was down slightly in 2022, but a recent Forbes article cited close to $84 trillion (yes, you read that right!) will be passed down from older generations between now and 2045. This offers hope that our partners can benefit from generous estate gifts.

Factor #2: Inflation

According to author Stephen D. King (the economist, not the thriller writer), “Inflation is a phenomenon that involves not just money, but also beliefs, social conventions, and trust.” In other words, inflation is complex and creates resounding effects!

In 2022, consumer prices were up roughly 6.5% year over year. Let’s assume someone gave $100 to charity in 2021 and then gave $100 again in 2022. That $100 donation in 2021 quickly into a contribution of just $93.50 after the effects of inflation! That donor gave less, not by choice, but because inflation eroded away some of the value of their money.

The top-line decline of 10.5% in giving I mentioned above was already adjusted for inflation. In “real dollars”—not adjusting for inflation—total giving declined only 3.4%. But for the organizations we serve, “buying power” is an important factor and should be accounted for. The true value of donation income has a direct impact on how far our partners can spread their important mission work! It’s also important to note that the uncertainties surrounding inflation and overall economic conditions may have impacted peoples’ decisions on how much to give, as we mentioned above.

Factor #3: Markets

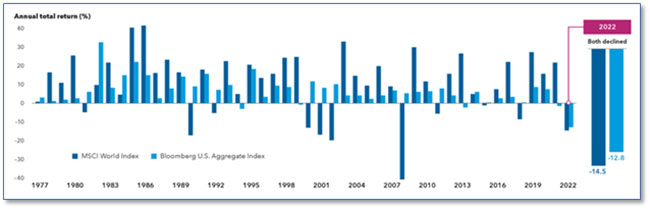

While 2023 has been solid for the markets thus far, let’s not forget that 2022 was a difficult year for many investors. As we have previously noted, both stocks and bonds exhibited a double-digit decline, which is an unusual occurrence in the markets.

Despite this year’s positivity, the impact of this decline will still be felt greatly by our partners since many foundations and other not-for-profits use a rolling three-year average market value when deciding on spending.

Furthermore, GivingUSA notes that research has found a statistically significant correlation between total giving and the performance of the S&P 500 stock market index. We noted earlier that financial market unrest may have contributed to a decline in giving—the research tends to bear this out.

Other Giving Trends Impacting Our Clients

The above factors are a few of the trends within data about overall giving that seem to have a clear cause-and-effect relationship to the income of not-for-profit organizations like the ones Wespath serves. Looking deeper, there are even more interesting takeaways relevant to our partners:

All these trends reveal both headwinds and signs of positivity for our partners. We’ll continue to keep a close eye on the trends impacting our clients so that we can better serve their investment needs.

We have updated our website with a new look and made it simple to navigate on any device.

We will continue to add more valuable information and features. Please let us know how we are doing.

P.S. For plan sponsors and plan participants, we have a new look for you too. Check out the Wespath Benefits and Investments website.