By Joe Halwax, CAIA, CIMA

Managing Director, Institutional Investment Services

April 2, 2024

Fun fact: This quarter marked the 38-year anniversary of Microsoft’s initial public offering. The software giant went public on March 13, 1986, at $21 per share. On a split-adjusted basis, that IPO price was effectively $0.0729 per share. Microsoft shares closed at $415.10 on March 13, 2024.

Since the IPO, the average annual return for Microsoft has been 26.2%, which compares to the S&P 500’s annualized return of 10.4% during that same time. I know we talk a lot about having a long-term perspective, but these numbers are staggering. I wonder how many investors can say they bought and held Microsoft all these years?

| Index | Q1 2024 |

| S&P 500 | 10.6% |

| MSCI ACWI ex-U.S. IMI | 4.3% |

| Bloomberg U.S. Aggregate | -0.8% |

| Bloomberg Global Aggregate | -2.1% |

| Russell 1000 Growth | 11.4% |

| Russell 1000 Value | 9.0% |

At the beginning of 2023, many investors expected an imminent U.S. economic slowdown, or even a recession, and a series of Fed rate cuts to go along with it. Fifteen months later, we are seeing substantial economic downturns in several countries, from the U.K. and Ireland to Japan and Germany. But the U.S. remains notably strong. Instead of a hard or soft landing, we’ve had no landing… yet.

U.S. stocks positive despite lack of soft landing

The current U.S. equity rally started in the fall of 2023 after the Fed signaled that the rate hike cycle was close to over after a five percentage points rise in the Fed Funds Rate from March 2022 to July 2023. From the lows of October 2023, the S&P 500 has rallied nearly 30% and added $10 trillion in market value.

Initially, stocks moved higher in anticipation that the Fed would soon begin cutting rates. This would, investors expected, begin to lower borrowing costs, increase consumer activity and lead to less-attractive yields in alternatives to stocks like money market funds.

But through the first quarter of 2024, U.S. economic data has remained somewhat strong. Inflation is still over 3%, and expectations for Fed rate cuts have been pared back—down from seven expected cuts of 175 total basis points at the start of the year to just three expected cuts of 75 basis points anticipated in 2024 as of the end of March.

Despite the change in rate cut expectations, U.S. stocks have continued to climb higher, led by growth and technology names. The S&P 500 returned 10.6% in the first quarter, touching a new high of 5,245 at the end of March. The tech-heavy NASDAQ also set new highs during the quarter and posted a gain of over 9%.

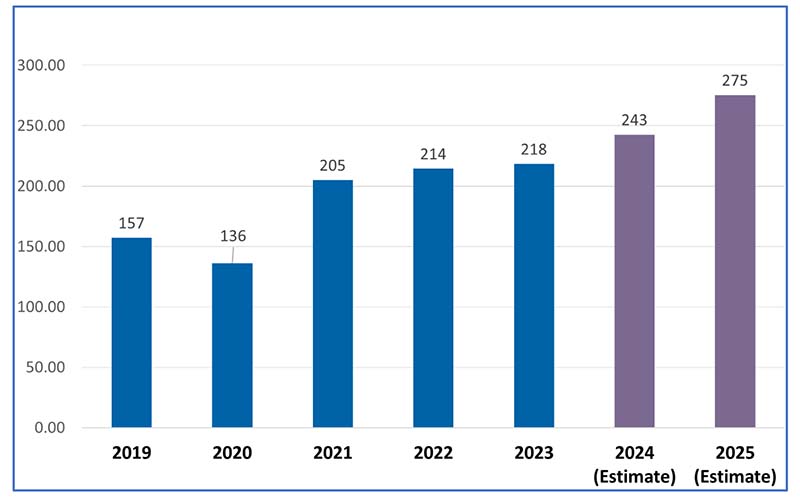

With returns in equity markets now somewhat decoupled from yield curve movements and interest rate expectations, greater attention is being paid to corporate earnings. Earnings are expected to rise in 2024, and if the current rally is to be derailed, it would likely be due to a miss in corporate earnings.

(Source: FactSet, Wespath)

The latest on the Magnificent 7

While the phrase “Mag 7” is getting a bit long in the tooth, these seven mega-cap names returned 17% in Q1, though we are starting to see some divergence in their returns.

Nvidia continues to benefit from the focus on AI, reporting better-than-anticipated quarterly results on already lofty expectations for revenue and net income. The AI chipmaker was up by 82% on the quarter and has gained 225% in the past year.

Tesla has been the weakest member of the M7 recently, with shares down by 29% for the quarter, and more than 50% from their 2021 highs. Apple shares were also down about 7% in the first quarter. The M7 may be shrinking to the M5, or better yet, perhaps we can retire this industry term like we did with FAANG!

If you haven’t checked it out already, I shared some thoughts on the M7, including touching on the comparisons between today’s era and the dot-com bubble era, back in March: Are the Magnificent 7 Stocks Creating a New Dot-Com Bubble?

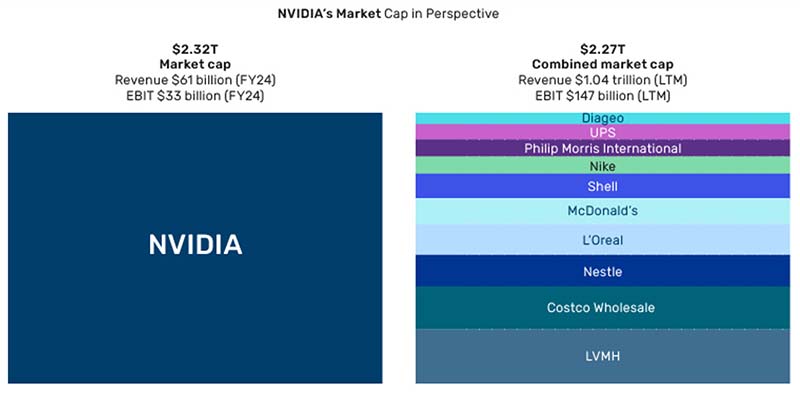

As I mentioned in that blog, there’s little doubt the quality of the M7 companies is vastly better than the Pets.coms or Webvans of the 1990s. But all assets can get overpriced. Nvidia is now larger than the value of Diageo, UPS, Philip Morris International, Nike, Shell, McDonald’s, L’Oreal, Nestle, Costco Wholesale and LVMH, combined:

(Source: Man Group, Bloomberg, Quartr)

International equities broadly positive, but uncertainties persist

International stocks are positive on the year but are also showing wider divergence at the country level. The MSCI ACWI ex-U.S. Index was up 4.3% on the quarter, while the MSCI Emerging Markets Index gained 2.2%.

Within developed international markets, economic growth remains weak. As noted above, several countries are already experiencing recessions. But monetary easing is expected, which is generally helping support stocks.

On the other hand, however, one country with a surging stock market—Japan—is raising interest rates. Japan’s Nikkei 225 set record highs after 35 years, and the Bank of Japan hiked its short-term borrowing rate (to zero) for the first time in 17 years. Japanese companies continue to benefit from corporate reforms and a very weak yen, weighed by years of easy monetary policy.

Within emerging markets, India remains the darling, up over 40% the past year (Indian ETF ticker EPI) and clearly continuing to benefit from negative investor sentiment toward China. Over the past year, India has outperformed the S&P 500; however, it is also one of the most expensive stock markets when looking at price-to-earnings ratios.

Yield curve shifts higher, bond prices negative in Q1

The Bloomberg U.S. Aggregate Bond Index posted one of the strongest quarters on record in Q4 2023 (up 7%) after the Fed signaled the end of rate hikes. But in Q1, the index was slightly negative at -0.8%, with credit spreads remaining relatively tight and the yield curve moving higher. U.S. 10-year Treasury yields are up from 3.95% in January to 4.2% in late March, while two-year yields have risen from 4.25% to 4.6%.

On March 20, the Fed met and provided a somewhat dovish stance on monetary policy, with comments such as “We see three cuts this year” … “Inflation tends to be seasonally high this year” … and “A strong labor market is not a reason to not cut.” The central bank’s forecast suggested that stronger U.S. growth will not lead to more inflation, which, if true, is a good background for asset prices.

U.S. economic data still strong, weakness seen globally

| Country | 12-Month GDP Growth Rate (as of December 31, 2023) |

| United States | 3.1% |

| China | 5.2% |

| Australia | 1.5% |

| Canada | 0.9% |

| Germany | -0.2% |

| United Kingdom | -0.2% |

(Source: TradingEconomics.com, Wespath)

As noted above, continued U.S. GDP growth has emerged as an anomaly among major global economies. We’ve written before about how the U.S. spent more to address COVID and the economic recovery, leading to significant increases in our national deficit. The U.S. also benefits from being the home of major corporations on the pulse of new technologies, like the Magnificent 7, and the dollar of course remains the world’s reserve currency.

We’ve ended many of our market commentaries over the past two years with something along the lines of “Markets will continue to react to inflation and interest rate expectations.” That’s probably still true, especially if inflation continues to run above 3% and if estimates for rate cuts continue to pare back, but we’re starting to see new dynamics emerge as well.

Earnings expectations are back in focus. Some elements of the Magnificent 7 are showing weakness. International stocks and economies are diverging somewhat. From our perspective, it’s as good a time as ever to be focused on your diligent approach and preparing for both risks and opportunities. Please contact our team with any questions you may have.

We have updated our website with a new look and made it simple to navigate on any device.

We will continue to add more valuable information and features. Please let us know how we are doing.

P.S. For plan sponsors and plan participants, we have a new look for you too. Check out the Wespath Benefits and Investments website.