March 24, 2023

My colleagues Trent Sparrow and Amy Bulger recently penned a blog describing the process for our recent review and refresh of Wespath’s Investment Beliefs. Likening the project to a modern “reboot” of a classic film franchise, Trent and Amy eloquently explained that Wespath’s core convictions haven’t changed. Rather, the subtle updates to our beliefs will help our stakeholders better understand how they influence the way Wespath positions its investments in alignment with our convictions.

I’d like to expound further on one of those beliefs—“Diversified, Long-Term Perspective”—and examine some of the specific investment strategies resulting from it.

As Trent and Amy wrote, this belief “describes the concept of not putting all your eggs in one basket.” Hence, we share our conviction in the belief statement that, “Global diversification across a broad range of asset classes, investment styles and asset managers improve risk-adjusted returns to our investors.”

Wespath’s Investment Beliefs: Diversified, Long-Term Perspective

Frank Holsteen, Managing Director, Investment Management, discusses one of our five Investment Beliefs: Diversified, Long-Term Perspective. Frank reiterates the importance of fundamental investing behaviors like diversifying assets and analyzing investments through a long-term lens. He also touches on how we evaluate and implement broader global changes into our portfolios.

Acting on this belief, Wespath has built and manages an investment program with significant diversification—not just across asset classes, investment styles and asset managers, but also with a focus on the very first word of the above quote: global.

Wespath holds meaningful allocations to international securities—stocks and bonds from companies based outside the U.S.—across our investment platform. These international investments include allocations to securities from advanced economies such as Germany, Japan and the United Kingdom, as well as developing economies or “emerging markets” like China, Brazil and India.

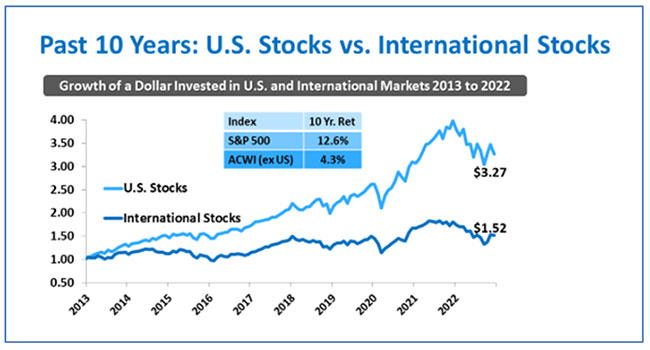

As detailed in the aforementioned Investment Belief, we invest in international companies because we believe in their potential to improve long-term risk-adjusted returns to our investors. However, many of our investors have noticed that, over the past 10 years, returns from international investments—particularly non-U.S. stocks—have failed to keep pace with their U.S. counterparts:

(Source: Wilshire Compass, MSCI, S&P, Wespath. Data as of December 31, 2022. “U.S. Stocks” is S&P 500 total return. “International Stocks” is MSCI All Country World (ex. U.S.) ($Gross). Data from 12/31/2012 to 12/31/2022)

As the above chart illustrates, a dollar invested in the U.S. stock market 10 years ago is worth over twice the amount compared to a dollar invested in international stocks. Stated differently, the average annual compounded rate of return over this period was 12.6% for U.S. stocks compared to just 4.3% for international stocks.

I imagine that this information would make at least some of Wespath’s participants and institutional investors justifiably question Wespath’s rationale for continuing to invest in international markets. Some have also expressed a belief that U.S. stocks will continue to outperform international stocks due to a variety of factors, including greater U.S. economic stability, a regulatory environment that better protects investors and the ease of buying and selling U.S. securities, among other considerations.

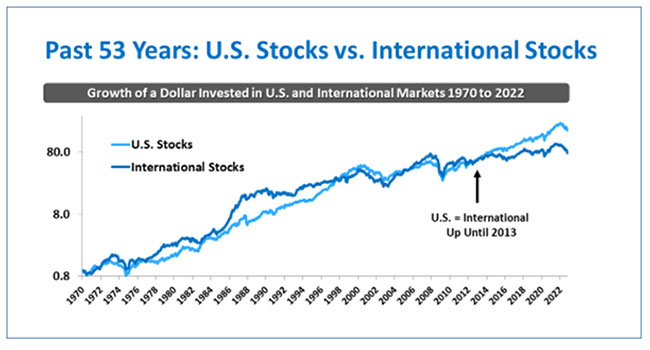

Before addressing these issues, let’s zoom out a bit and examine a longer history of stock market performance: 1

(Source: Wilshire Compass, MSCI, S&P, Wespath. Data as of December 31, 2022. Log scale. U.S. Stocks is S&P 500 total return for entire period. International stocks is MSCI EAFE Index ($Gross) from 12/31/1969 to 1/31/1988 and MSCI All Country World (ex. U.S.) ($Gross) from 1/31/1988 to 12/31/2022)

The above chart tells a slightly different story than our previous 10-year snapshot. There were times when U.S. stocks did better, just as there were times when international stocks outperformed, but averaged out over the 43 years from 1969 to 2012, returns were comparable.

International stocks’ ability to match U.S. stocks during that period is impressive when considering historical context. Think of how much global economic development occurred over those four decades. Returns for international stocks kept pace with U.S. stocks despite even more unfavorable comparisons to the U.S. in terms of economic stability, investor protections and the maturity of financial markets.

One might have expected this trend to continue, or even lead to more consistent outperformance as international countries developed further in the past decade. So, what changed after 2012 that contributed to the opposite outcome?

A major part of the answer can be traced to specific investments that have been among the most successful during the last 10 years—a handful of U.S. companies leading the technology revolution: Amazon, Apple, Microsoft, Alphabet (parent company of Google), Meta (parent company of Facebook), auto manufacturer Tesla, and chip maker Nvidia. In addition to the unique and disruptive technologies developed by these companies, the financial conditions experienced in the past decade, defined by ultra-low interest rates, allowed them to borrow money cheaply and grow rapidly by buying up competitors and investing in even newer technologies.

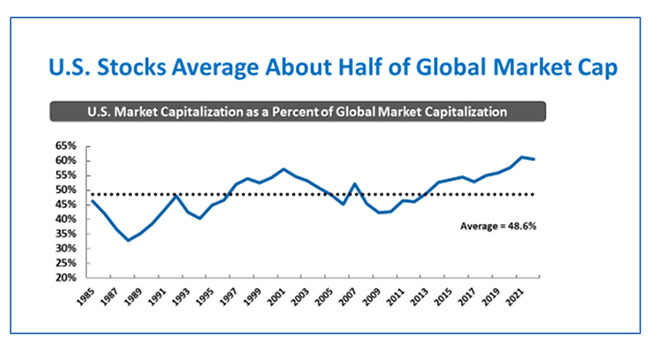

The result is pretty astonishing. The value of U.S. stocks as a share of global markets is near historic highs:

(Source: FactSet, MSCI All Country World Index. Wespath. Data as of 12/31/2022)

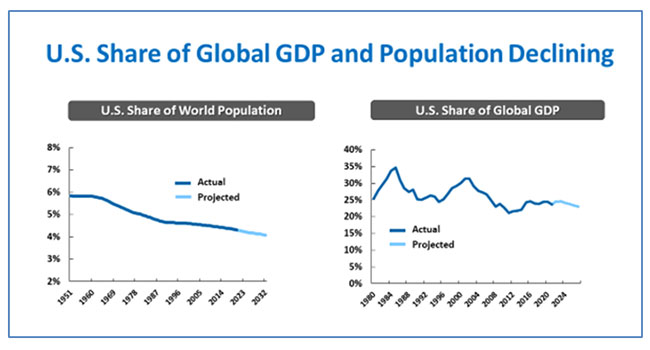

Despite the fact that the U.S. share of global economy activity and total population continues to decline:

(Source: International Monetary Fund, World Economic Outlook, October 2022. United Nations Department of Economics and Social Affairs, Population Division, World Population Prospects, 2022)

Keeping this in mind, let’s return to our original question: why does Wespath maintain its conviction in international investments? My answer focuses on a few overarching conclusions drawn from the above data and consideration of other market forces:

Shifts in financial conditions and the challenge of timing markets: As noted, the outperformance of U.S. stocks over the past 10 years is owed in large part to the performance of specific companies which benefited from their disruptive technologies and certain financial conditions. Today, interest rates have risen worldwide, and it’s difficult to predict whether these same companies will remain in favor for another decade.

This underscores the challenge of market timing. Our snapshot of performance over several decades shows several multi-year periods where international stocks outperformed. By taking a long-term approach and remaining disciplined with our diversified allocations, we seek to benefit from the natural ebbs and flows of market preferences over time.

Economic opportunity in international countries: The misalignment between U.S. companies’ share of the global stock market and the U.S.’s share of global GDP and population points to an opportunity for non-U.S. companies. The middle class is growing rapidly in developing countries like Brazil, China, India and Indonesia. This should lead to continued economic growth and greater demand for consumer goods, healthcare services, travel and entertainment. Foreign-owned financial services companies, food producers and retailers, online and retail stores, healthcare providers, communications companies, and utilities all stand to benefit.

Further, we should not forget the contributions of non-U.S. companies to the tech revolution. Dutch semiconductor equipment manufacturer ASML Holdings, Taiwanese chipmaker TSMC, Korean electronics giant Samsung, and Chinese technology and entertainment conglomerate Tencent are just a few of the leading tech companies based outside of the U.S.

Valuations and economic factors working against U.S. stocks: Common stock valuation metrics include the price-to-earnings ratio, the price-to-book ratio and dividend yield. International stocks currently represent better “value” to investors when applying all three of these metrics. That could mean investors are just comfortable paying a premium to own U.S. stocks, but it could also be a big opportunity for non-U.S. investments if and when “value” stocks are in vogue. Also, investors should consider that increasing national debt levels in the U.S. could threaten the strength of the U.S. dollar, which is generally positive for international stocks.

As always, I remind our readers that Wespath remains steadfastly committed to the prudent stewardship of our participants’ and investors’ assets. I know it can be tempting to conclude that “past is prologue” and that old trends which favor global diversification will not return. But our experience tells us that efforts to predict that “this time is different” are incredibly challenging. We continue to believe that global diversification is an essential feature of our investment strategy.

1 This chart illustrates the performance of U.S. stocks and international stocks from 1969 – 2022. While stock market investing outside the U.S. dates back further than 1969, this year was chosen because it marks the launch of the first international equities index.

What themes would you like us to cover in future blog posts? Let us know at [email protected]

To receive this chart each week via our Wespath Market Update e-mail, please contact our team at [email protected].

We have updated our website with a new look and made it simple to navigate on any device.

We will continue to add more valuable information and features. Please let us know how we are doing.

P.S. For plan sponsors and plan participants, we have a new look for you too. Check out the Wespath Benefits and Investments website.