By Jake Barnett

Managing Director, Sustainable Investment Strategies

and Sylvia Poniecki

Director, Impact Investments

September 21, 2023

If you own a home in the U.S. and have noticed your insurance has increased over the last several years, you are not alone. The national average for homeowners insurance has been rising for the last five years, with a cumulative increase of 19.1% between 2018 and 2023. There are a number of reasons for this spike, including rising construction costs linked to inflation and, interestingly enough, the effects of climate change.

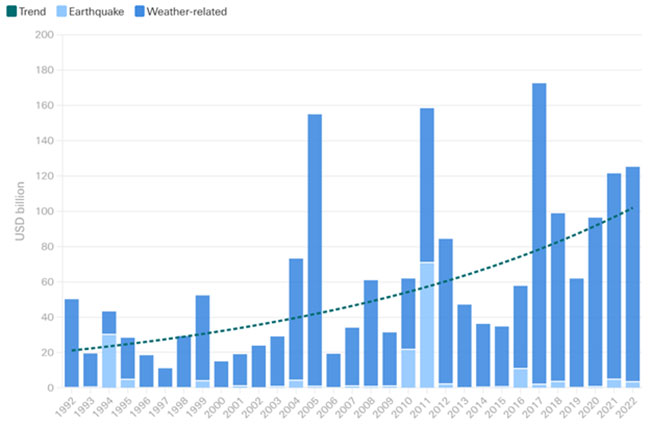

The model of issuing insurance is based on probabilities. To put it simply, the amount that homeowners pay for insurance is linked to the likelihood of something bad happening to your house and the amount of potential damage. Unfortunately, the likelihood of natural disasters causing damage to your home has been growing . Swiss Re, one of the world’s largest reinsurance companies, illustrates a steady increase in natural catastrophe payouts over the last 30 years, with payouts more than quadrupling in that time: Swiss Re projects that this trend of increasing losses will continue at a clip of 5-7% annually.

The graph illustrates total insured losses, which include—but are not limited to—homeowners insurance losses.

Growth in Global Natural Catastrophe Insured Losses (2022 Prices)

Given this increase and the nature of the insurance business, it makes sense that premiums (the amount homeowners pay each month) have gone up overall. It’s also worth thinking about how these broad trends have been magnified in specific regions. Coastal regions in the U.S., for example, are highly susceptible to an increase in disruptive natural disasters, and their insurance markets have paid the price.

Insurance Industry Volatility Hits Coastal States

Major insurers made national headlines this year when they withdrew from multiple coastal states. In July, Farmers Insurance announced it would stop offering policies in Florida, joining more than a dozen insurance companies that have pulled out of the state. Meanwhile, homeowners insurance rates have increased 42% compared to last year and while estimates vary widely, an insurance industry association spokesperson said the average Floridian now pays about $6,000 for their yearly premium. The average national annual premium is $1,700.

In California, State Farm cited “rapidly growing catastrophe exposure” as a key reason it would stop accepting new applications for homeowners insurance. A Louisiana State University report found that 17% of homeowners insurance policyholders in the gulf state had their policy canceled in 2022, leaving them with higher costs and fewer options.

This rise in rates has not been enough to inhibit migration or to significantly disrupt economic activity to-date. Florida and Texas, two states highly susceptible to natural disaster, were also the two states which saw the highest population gains in 2022. Many new residents cite cost of living as a factor in their move.

Amid insurance getting more expensive and inaccessible, some homeowners are going “naked” (without insurance coverage) or turning to the state government as a back-stop. However, neither of these are truly sustainable options in their current form, as is detailed in thorough reporting on Florida’s insurance market in the October 2022 episode of “The Daily” podcast.

Some of the dry statistics and trends can also gloss over the devastating human impact that is present when losing a home to a natural disaster. The recent tragic wildfires in Hawaii, for instance, demonstrated the urgent need for more action to be taken to mitigate and reduce these events in the future. It’s also true that insurance industry volatility can have an outsized impact on the less fortunate, including those struggling with housing affordability.

Impact on Affordable Housing

Insurance premiums on multifamily properties have spiked. Over the past year alone, insurance premiums increased by 26% on multifamily properties in the U.S. and many in the multifamily industry are worried that hefty increases to insurance costs will paralyze an already fragile housing market.

Limited insurance options and hefty premiums, along with other factors such as inflation and higher interest rates, are straining net operating income on existing properties and putting new developments at risk of being delayed or scrapped. This has the potential to further increase the shortage of affordable units, which are desperately needed around the country.

Affordable housing is more sensitive to rising insurance costs because rents are capped at these properties. Any limited increases in rental income may not be sufficient to offset significant increases on insurance premiums.

Our readers likely know that affordable housing is an important topic to us here at Wespath. Since 1990, Wespath has worked to promote affordable housing for underserved areas in the U.S. through its Positive Social Purpose (PSP) Lending Program. Wespath has invested over $1.9 billion in U.S. affordable housing since the program’s inception.

In addition to investing in affordable housing, at Wespath we continue to work diligently to support a sustainable global economy. Access to housing is clearly an important element of a sustainable economy, and it’s crucial that housing opportunities are both safe and affordable.

To curtail the negative impacts of extreme weather events, it’s crucial to incorporate climate resilience into housing planning and developments, especially at affordable housing properties where budgets have limited flexibility to bear added costs. At Wespath, we partner with organizations that focus on investing in resilient infrastructure, promoting energy-efficient and sustainable building practices, and ensuring equitable access to safe affordable housing for vulnerable populations affected by climate change and weather disasters.

A good example of sustainable building practices can be found at West End Heights, an Ithaca, New York, property Wespath invested over $1.8 million in earlier this year. West End Heights features fossil fuel-free electric heat pumps to heat and cool residences. Heat pumps are an important climate mitigation and cost-saving tool since they tend to be more energy and carbon efficient, and they are reliable for operating in the extreme temperatures caused by climate change.

Specific to insurance, we engage our external asset managers—particularly those focused on real estate investments—on how they are thinking through physical climate risk, including the potential for insurance rate hikes, and asking them to do more to create resilient and adaptable properties.

We also continue to work to address climate change, including with institutional investor peers who represent insurance organizations. Our collaboration with global insurer Allianz through the Net-Zero Asset Owner Alliance was featured in our recently published Sustainable Investment Report. Ultimately, as Jake’s good friend from Allianz, Patrick Peura, was quoted as saying in Investment & Pensions Europe, these collaborations will continue to focus on “real world change that we’re looking to drive to protect our core insurance and pension businesses.”

We have updated our website with a new look and made it simple to navigate on any device.

We will continue to add more valuable information and features. Please let us know how we are doing.

P.S. For plan sponsors and plan participants, we have a new look for you too. Check out the Wespath Benefits and Investments website.