By Jon Strieter

Analyst, Impact Investments

September 25, 2023

At Wespath, we are proud to showcase how we invest retirement savings and institutional investor funds in ways that align with our shared Methodist values.

My colleague Trent Sparrow wrote a post on our Investment Insights blog at the end of 2022 in which he highlighted several ways we put our Sustainable Economy Framework into practice with investments, engagements and avoidance.

As Trent explained, our Framework highlights our belief that investors can collaboratively support a transition to a sustainable global economy that delivers healthier financial markets, more resilient companies and greater financial security for Wespath’s benefit plan participants and institutional investors.

While we have always been able to highlight investment strategies and specific investments that help us achieve our aspirational vision for the economy, until recently we were not able to assess if our equity funds in totality are helping to move the world toward a more sustainable future.

To help address this challenge, we recently created an impact measurement and management (IMM) tool to help us understand how aligned—or not aligned—our investment portfolios are with the Framework.

The Purpose

In the simplest terms, the IMM tool is a resource that helps us understand how our investments align with our Framework by highlighting the positive and negative impacts of our portfolios . This helps us achieve one of the two main objectives that the UMC calls us to do.

The UMC asks that Wespath: “discharge its fiduciary duties … solely in the interest of the participants and beneficiaries” (The Book of Discipline, ¶1504.14) and “make a conscious effort to invest … with the goals outlined in the Social Principles” (The Book of Discipline, ¶717).

We gauge our success as a fiduciary by analyzing investment returns in numerous ways. For instance, we regularly measure our fund performance against peers with similar investment objectives. We also measure and report how our funds compare to benchmark indexes comprising similar investments.

The IMM tool supports the other core ask made in The Book of Discipline: to aspire to align our values with the UMC Social Principles. Wespath believes that achieving our Sustainable Economy Framework requires people around the world to have reliable access to basic necessities, such as sustainable food and water, equal opportunity to access quality jobs and healthcare, and a foundation of a resilient and thriving ecosystem. All these elements of the Framework align nicely with the UMC Social Principles, so by measuring how much progress we have made in achieving our objectives as outlined in the Framework, the IMM tool also helps us to quantify our alignment with the Social Principles.

How Are We Measuring Impact?

Our Sustainable Investment Report includes a story about the IMM tool and details the steps we took to create the tool and how the tool organizes data. In summary, we chose an industry-leading data provider that assessed companies’ products and services and ranked them on a sliding scale from “significant obstruction” to “significant contribution” to sustainable development in 15 categories.

For example, if a company primarily generates revenue from the sale of fruits and vegetables, it would be classified as a company that significantly contributes to the sustainability objective of combating hunger and malnutrition. Conversely, if a company generates revenue largely from the sale of sweets and refined sugars, it is classified as a significant obstructer.

Once a company’s revenue is evaluated, our data provider uses an aggregation formula to generate an overall score.

Data in Action

This standardized scoring mechanism facilitates cross-industry comparisons at the company level, while also offering the flexibility to aggregate data at the fund or benchmark level for the purpose of evaluating specific baskets of companies. The IMM tool includes an interactive dashboard that allows us to assess the alignment of our investment funds with their respective benchmarks in terms of sustainable development.

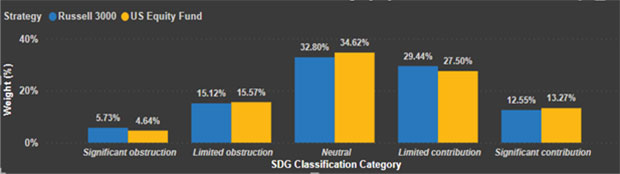

For instance, the tool shows that the U.S. Equity Fund typically exhibits a high degree of concordance with its benchmark in terms of its contributions and obstructions to sustainable development (or SDGs).

We are regularly working to refine and improve the IMM tool. Since the Sustainable Investment Report story was published, we have added several new features.

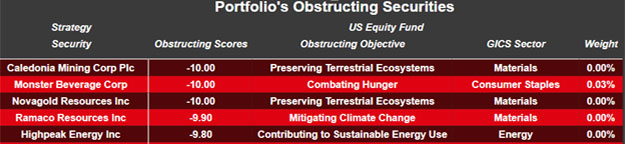

We can now unpack a company’s overall sustainable development score and conduct in-depth analyses. We can dig deeper and search to see how a company is contributing to or obstructing the Framework in each of the 15 sustainable objectives. This in-depth company level analysis provides Wespath more data about portfolio characteristics and the influence of companies within our investment strategies, which helps to inform and shape our engagement discussions, particularly with our external asset managers, about the impact of the companies in which we invest.

Looking Ahead

As the adage goes: “What gets measured gets managed.” The IMM tool is the first phase of our efforts to measure the sustainability impacts of our portfolios as they relate to the Framework and Social Principles.

We recognize the underlying data is still in the “early innings” and relies on estimates and methodologies that will almost assuredly develop further over time. Therefore, when utilizing the IMM tool to inform discussions with our asset managers, we will be listening to our managers and external partners to better understand the full picture of a company’s positive and negative impacts on society. These efforts represent the next phase of the project—to apply our initial observations to new conversations which can help us better understand how our investments align with the Framework. Next year, we intend to add information about company exposure to human rights and climate risk to the IMM tool to further inform our engagements with managers.

We also recognize that measuring the full impact of our portfolios will require that the tool expand to our fixed income and private market investments, among others, and that will present its own measurement challenges. Nevertheless, we value this first phase of the process and look forward to using this new tool to influence our portfolios' impacts and drive greater consistency with our vision for a sustainable global economy.

We have updated our website with a new look and made it simple to navigate on any device.

We will continue to add more valuable information and features. Please let us know how we are doing.

P.S. For plan sponsors and plan participants, we have a new look for you too. Check out the Wespath Benefits and Investments website.