By Dave Zellner

Chief Investment Officer

July 11, 2023

Last month, I attended an event in New York that coincided with the release of the first standards set by the International Sustainability Standards Board (ISSB). For me and others who have contributed to the development of standardized sustainability disclosures for years, it was a cause for celebration. I truly believe ISSB will become the leader in sustainability reporting, helping solve one of the biggest challenges facing sustainable investors today.

I also recognize that many readers have not heard of ISSB and do not know what challenge I’m referring to! With this in mind, I wanted to dive further into the topic in this blog.

The Fiduciary Need for Information

As my colleagues and I have written about extensively, Wespath is committed to integrating a comprehensive approach to the stewardship of participant and institutional client assets. This commitment principle is consistent with The United Methodist Church’s (UMC) directive that Wespath prudently manage investments in the best fiduciary interests of our participants and beneficiaries (The Book of Discipline, ¶1504).

At their core, fiduciaries—those acting in the best financial interests of others—are decision makers. We make choices that impact our stakeholders, and we try to make sure all those choices lead to the best possible outcomes.

Decision makers need to ensure their choices are based on accurate, reliable and all-encompassing information. For Wespath and our asset managers, this means considering—and gathering information about—all the potential risks and opportunities that could affect the performance of the assets we steward.

For example, our investors know that we consider the possible impacts of sustainability-related issues on our investments. We’ve developed what we call our “Sustainable Economy Framework” to guide our approach to sustainability in investment decision-making (read more: The Three Pillars of a Sustainable Global Economy).

Criticism of Sustainable Investing

Recently, investors that consider sustainability—or environmental, social and governance (ESG)—issues have come under fire from various economic pundits and elected officials. I’ve written about this trend previously and have sought to address many of the common arguments (read more: ‘ESG’ strikes a nerve, why it shouldn’t). Importantly, I emphasize that Wespath’s objective in considering ESG factors is solely to improve long-term investment returns for our stakeholders, in line with our role as a fiduciary.

I’ve also acknowledged that some criticisms of ESG are valid. For instance, I agree that the sustainable investment landscape is affected by inconsistency—especially inconsistent data collection and reporting methods.

Consistency is obviously important. Without it, it’s challenging to accurately evaluate and compare the performance of different companies and investors.

Fortunately, the sustainable investment community is aggressively working to address the issue of information consistency.

The Evolution of Sustainability Data and Disclosure

Investors are the primary users of company financial reports, but those financial reports are often lacking in “non-financial” disclosures about sustainability topics (such as water use, energy efficiency, carbon emissions and workplace safety) that are relevant to company performance. The goal of developing consistent and standardized sustainability information is to help investors make better, more informed investment decisions by providing reliable data on these types of topics.

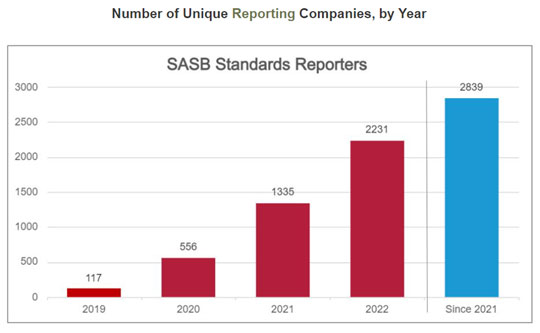

One of the most important moments in the development of consistent sustainability information was the launch of the Sustainable Accounting Standards Board (SASB) in 2011. SASB sought to standardize and promote industry-specific non-financial disclosures that were material to company activities and of interest to investors.

SASB was one of the first to recognize that the risks associated with climate change, resource depletion, social inequality and corporate accountability required greater transparency and consistency. The SASB Standards, which were eventually published in 2018, offered a framework for standardized reporting on these issues—in a similar format to how companies report on traditional accounting metrics like earnings and revenue. These standards quickly gained momentum:

(Source: https://sasb.org/about/global-use/)

Wespath, an inaugural member of the SASB Investor Advisory Group, has supported SASB’s development through the years, and we’ve always been proud of its progress.

Still, there was a need for consolidation in the industry. SASB wasn’t the only group working on sustainability disclosure guidelines, and the adoption of various different approaches threatened the outcome of consistency that SASB and others were hoping to solve.

In October 2021, SASB and several other sustainability disclosure organizations coalesced within the newly formed International Financial Reporting Standards Foundation, which then announced its intention to create the International Sustainability Standards Board.

The Importance of ISSB

ISSB seeks to become the leading standard-setter for sustainability disclosures and aims to cover a wide range of sustainability issues with its reporting standards—including climate change, biodiversity, human rights, labor practices, supply chain management and more. Like SASB before it, ISSB hopes to solve the problem of sustainability and ESG information consistency by setting standards for company disclosures that promote transparency, comparability and accountability.

Last week, ISSB launched its first two standards. The first standard covers general sustainability disclosures, and the second standard encompasses climate-related disclosures. These standards were developed through an extensive and collaborative process—one which considered feedback from investors, companies, the accounting industry, regulators and others. To learn more about the first two standards and what’s next for ISSB, please check out this helpful blog post: Ten things to know about the first ISSB Standards.

ISSB’s first two standards are a step toward a unified global approach to reporting sustainability information. That will be a positive for investors all around the world, including us here at Wespath.

As I’ve noted, Wespath envisions a sustainable economy characterized by social cohesion, long-term prosperity for all and environmental health. While this vision is aspirational, we know that our foundation must be informed decision-making. I firmly believe ISSB’s efforts will help to that end.

We have updated our website with a new look and made it simple to navigate on any device.

We will continue to add more valuable information and features. Please let us know how we are doing.

P.S. For plan sponsors and plan participants, we have a new look for you too. Check out the Wespath Benefits and Investments website.