By Myles Smith

Investment Analyst

October 30, 2023

For months now, news about the Chinese economy has been cause for concern. Disinflation, muted consumer spending, slowing foreign investment, a resurging real estate crisis and lower-than-expected consumer growth have all come to the forefront this year. In the event you haven’t followed all the developments or have only seen the headlines, we’ll provide a primer on these issues and then see how they have impacted Wespath’s investments.

First, let’s start with a little stage setting. At the beginning of 2023, China’s economy—the second largest in the world behind only the U.S.—was reopening after ending its zero-COVID measures in December 2022. Most pundits projected economic activity in the country to recover strongly. In fact, the World Bank, Goldman Sachs and J.P. Morgan were all saying roughly the same thing: China’s economy might endure a bumpy start to the year due to the lingering effects of COVID-19, but it will bounce back.

Where Is China Now?

Layered within projections for China’s economic recovery was the acknowledgement of several serious risks, including concerns about its property market, geopolitical tensions and global financial conditions. These notes proved quite prescient. Let’s take a closer look at those headwinds and what they mean for investors:

The rift between the United States and China is increasing, particularly in tech

After the Wall Street Journal reported in early September that China banned the use of iPhones by government employees at work, Apple’s stock fell 6.4% in the two days following the news, and the company lost about $200 billion in market cap in under a week. China is Apple’s largest international market.

It remains to be seen if the reported ban on iPhones for government workers will lead to any long-lasting effects on the company’s sales and revenue. The Chinese government has denied the reports, the iPhone remains popular with Chinese citizens, and Apple continues to manufacture much of its hardware in China. But still, the reported ban could be another chapter in the battle between the U.S. and Chinese governments over high-tech companies and devices. The U.S. had previously placed restrictions on Huawei, a massive Chinese telecommunications company.

China’s property market is in distress

Country Garden, a colossal real estate developer in China, made noise in August when it signaled it couldn’t pay its debt on time. It eventually told creditors it made a late interest payment within the 30-day grace period, according to The New York Times. However, that wasn’t the end of Country Garden’s troubles. In October, it announced it could not repay another loan on time and anticipated it would not make upcoming overseas debt payments.

A slump in sales of new apartments has led to extraordinary difficulties. The company reported $7.1 billion in losses in the first half of 2023.

Country Garden’s predicament calls to mind struggles faced by Evergrande, another Chinese real estate developer. Evergrande defaulted two years ago and eventually filed for bankruptcy in August. Fears over Evergrade’s default did lead to volatility in global markets back in 2021.

Foreign investment down, blue chips sell off

Data released by the Chinese government in August showed that foreign direct investment (when an investor, company or government from outside China acquires an ownership stake in a Chinese company or project, according to Investopedia) in China slumped in the second quarter to its lowest level since 1998, when recordkeeping began. Increasing costs from tariffs and wage growth, geopolitical uncertainty, and limited access during the COVID-19 lockdowns have caused companies outside of China to re-evaluate the benefits/risks of doing business in the country.

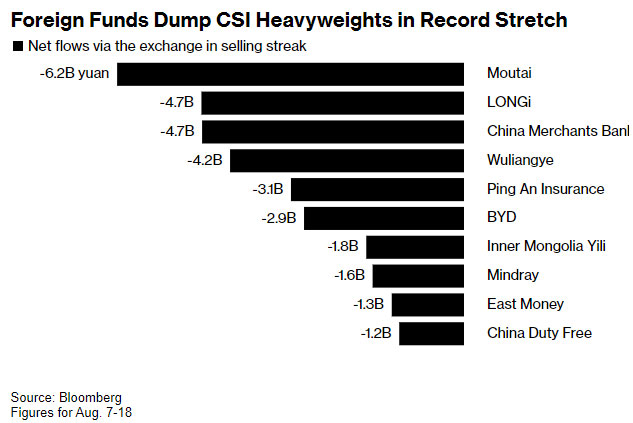

Many of China’s largest companies have seen withdrawals, or net outflows, recently. Analysis from Bloomberg shows that in early August the 10 most-sold stocks by outside investors were among the 50 largest companies in the CSI 300, a market cap weighted index of the top 300 stocks traded on the Shanghai and Shenzhen stock exchanges.

At the end of September, the MSCI China Index (a measure of large- and mid-sized companies across China) was down 7.29% year-to-date. It significantly underperformed U.S.-based equity indexes, such as the S&P 500 (+13.07%) and the NASDAQ (+27.11%), as well as a number of international equity indexes, including the MSCI AC World ex US IMI (+5.30%) and the MSCI Emerging Markets IMI (+3.38%) over that same time frame.

What Does This Mean for Wespath?

Wespath does have some direct investment exposure to China. For example, our International Equity Fund – P Series (for participants) and International Equity Fund – I Series (for institutional investors) both include holdings of Chinese stocks. In fact, both funds are overweight Chinese stocks, meaning they hold a higher percentage of Chinese companies than their benchmark, the MSCI AC World ex US IMI. Given the struggles of the Chinese market, Wespath’s overweight was a factor that hurt performance compared to the benchmark through the third quarter. As previously noted, the benchmark MSCI AC World ex US IMI was up 5.30% year-to-date through September. The International Equity Fund – P Series and International Equity Fund – I Series were up 2.84% and 2.78%, respectively, net-of-fees through the first nine months of the year. 1, 2

Capital Group, an asset management firm which manages emerging market strategies on behalf of Wespath, follows the Chinese economy closely. In its midyear outlook, Capital Group said: “No doubt when it comes to investing in China, there are clear challenges. Geopolitical tensions are elevated, medium- to long-term growth will likely moderate from the rate of prior decades and the property sector is mired in debt. That said, China has not relinquished its title as the world’s second largest economy, providing opportunities to selectively invest despite the risks.”

Capital manages equity strategies in both International Equity Funds. The firm also manages an emerging market debt strategy within the Fixed Income Fund – P Series and Fixed Income Fund – I Series. The Emerging Market Debt strategy has an underweight to Chinese bonds relative to its benchmark3 through the third quarter. This underweight has positively contributed to the strategy’s relative return through the same time period.

While the economic news coming from China can be worrisome, it’s important to remember Wespath maintains a “Diversified, Long-Term Perspective.” It’s one of our five Investment Beliefs, reflecting our charge to help participants save for retirement and institutional clients carry out their mission now and well into the future. As stated in the Investment Beliefs, “We build diversified portfolios of assets based on our long-term (30-40 years) risk and return assumptions. We may overweight or underweight sectors within asset classes based on valuation parameters compared to historic norms. Our asset managers are better positioned to assess near-term risks and take advantage of near-term opportunities.”

Wespath’s belief in not overreacting to the day’s headlines has paid off, as evidenced by our long-term net-of-fees performance for the aforementioned funds. The International Equity Fund – P Series’ annualized return since inception on December 31, 1997, is 5.70%, which bests the benchmark4 by 0.96%. The Fixed Income Fund – P Series launched on the same day and has an annualized return of 4.46% since inception—0.39% better than its benchmark.5

1The performance shown is for the stated time period only and computed in U.S. Dollars (USD). Historical returns are not indicative of future performance. Investment performance is presented net-of-fees. Please see each fund’s respective webpage for more information regarding fees, including how fees are reflected in performance. The investments of the funds may vary substantially from those in the applicable benchmark. The benchmarks are based on broad-based securities market indices, which are unmanaged, cannot be invested in and are not subject to fees and expenses typically associated with investment funds. Investments cannot be made directly in an index.

2 Please refer to the Investment Funds Description – I Series for more information about each Fund for institutional investors. Please refer to the Investment Funds Description – P Series for more information about each Fund for participants, conferences and other plan sponsors. Wespath investment funds are neither insured nor guaranteed by the government.

3 The Emerging Market Debt strategy performance benchmark is 50% J.P. Morgan EMBI Global Index and 50% J.P. Morgan GBI-EM Global Diversified Index.

4 The International Equity Fund performance benchmark is the MSCI All Country World Index (ACWI) ex USA Investable Market Index (IMI), effective January 1, 2008. The index measures the performance of equities of companies domiciled in developed and emerging markets, excluding the U.S. From January 1, 2006 through December 31, 2007, the benchmark was the MSCI ACWI ex USA Index. Prior to 2006, the benchmark was the MSCI EAFE Index.

5 The Fixed Income Fund performance benchmark is the Bloomberg U.S. Universal Index (excluding mortgage backed securities). The index consists of the U.S. Aggregate Bond Index, the U.S. High-Yield Corporate Index, the 144A Index, the Eurodollar Index, the Emerging Markets Index and the non-ERISA portion of the CMBS Index. Non-dollar denominated issues are excluded from the index. From January 1, 2003, through December 31, 2005 the benchmark was the Bloomberg U.S. Aggregate Bond Index. Prior to January 1, 2003, the benchmark had been the Bloomberg Intermediate Aggregate Bond Index.

We have updated our website with a new look and made it simple to navigate on any device.

We will continue to add more valuable information and features. Please let us know how we are doing.

P.S. For plan sponsors and plan participants, we have a new look for you too. Check out the Wespath Benefits and Investments website.