By Jake Barnett

Director, Sustainable Investment Stewardship

February 13, 2023

Wespath is always seeking to better understand the key environmental and social risks that our investment funds will need to navigate in the near- and long-term. As we head further into 2023, one key resource we consulted recently was the World Economic Forum’s (WEF) latest Global Risks Report.

In developing this annual report, the WEF surveys over 1,200 experts across academia, business, government and civil society on what they consider to be the most pressing risks for global society in the years ahead. “Global risk” in this context is defined as the possibility of an event or condition which, if it were to occur, would negatively impact a significant proportion of global GDP, population or natural resources.

Of course, Wespath may not fully agree with all the assessments from the survey respondents. Reports like this are one of many inputs we must consider when thinking about risks and economic trends. Nevertheless, we do believe that the top concerns identified by the WEF survey validate Wespath’s efforts to address the issues we must resolve to achieve our vision for a sustainable global economy.

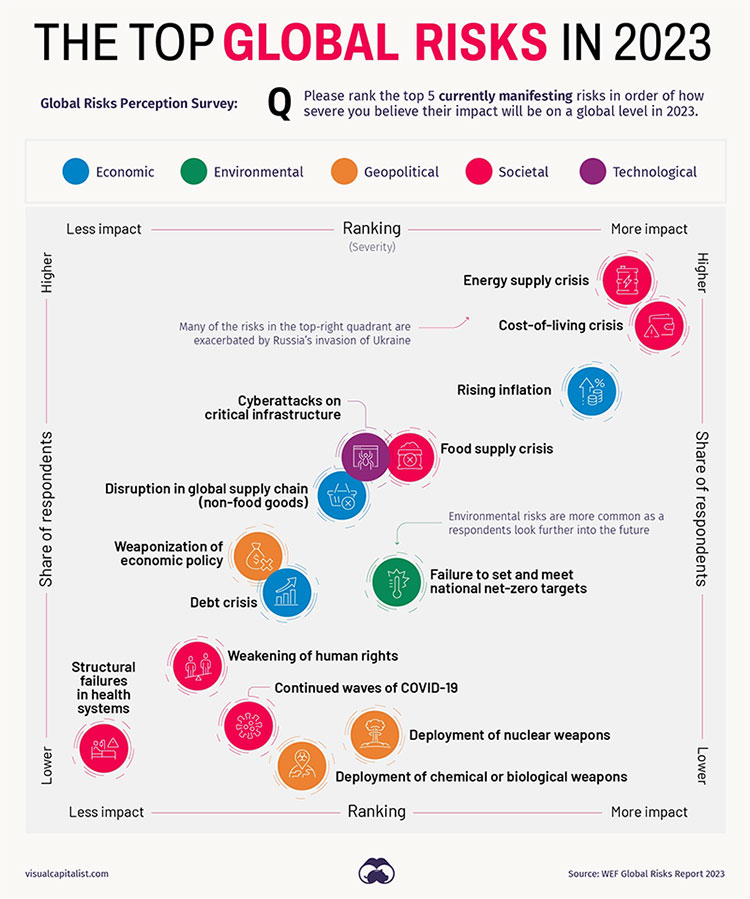

Below is a helpful visual summary of this year’s top currently manifesting risks, sorted by potential impact and frequency of mention by survey respondents:

Source: https://www.visualcapitalist.com/global-risks-2023/

In the above figure, we see the ongoing risks of the “Energy supply crisis” and “Cost-of-living crisis” in the upper right, which means a high share of respondents saw these risks as having a high impact. Both risks were exacerbated by Russia’s invasion of Ukraine, which has disrupted energy and agriculture markets, driving up everyday costs for fuel and food. The report explains how these factors and others have driven a “global new normal,” which has led to widespread concerns about food, energy and security.

Concerns around basic necessities are also driving global instability. According to the WEF, increases in fuel prices last year led to protests in an estimated 92 countries, with some of those protests resulting in violence, political upheaval and even deaths. These are very apparent risks that have manifested themselves over the past year.

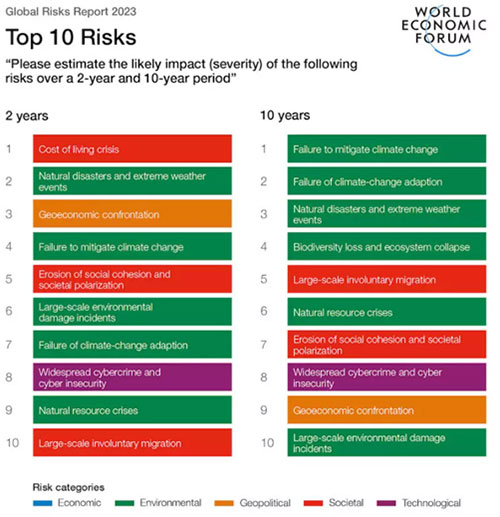

When looking further ahead, the focus of survey respondents seems to shift from near-term social and geopolitical concerns to environmental concerns. Here’s a snapshot of the top near-term and long-term risks captured in the report:

(Source: WEF Global Risks Report 2023)

The dominant presence of environmental risk in the 10-year time horizon is driven in large part by our inadequate collective efforts to address and mitigate the effects of climate change. Unfortunately, with many societies struggling to meet basic needs in the present, concerns about climate change—which can be more long-term oriented and abstract—often take a back seat.

Nevertheless, the report is clear that the world’s delay in addressing climate change will likely be costly: “All of this implies that the risks of a slower and more disorderly transition have now turned into reality, potentially leading to dire planetary and societal consequences. Any rollback of government and private action will continue to amplify risks to human health and spur the deterioration of natural capital” (WEF Global Risks Report 2023, Page 22).

So, what does all this not-so-cheery information mean for Wespath and how we manage our investment programs? Well, in short, we can learn from its insights and act on things where we have an opportunity to mitigate risks. More specifically, here are some ways we hope to leverage our analysis of this report in our year ahead:

Be clear-eyed in how we allocate capital: Many financial commentators have spoken recently about the potential for near-term volatility in the markets due, in part, to the same risks identified by the WEF’s survey respondents. This report underlines that these professionals do not anticipate these risks will go away anytime soon. That’s why we remain committed to a long-term investment perspective that considers myriad risks but is not derailed by “moment-in-time” events.

Do not get trapped in duality in thinking: One of my biggest takeaways from the report is that it shows how difficult it can be to think about any one risk in isolation. Many of the issues covered in the WEF report are intersectional and interact with each other. For example, the energy supply crisis makes it harder to turn off existing fossil fuel sources today, which makes future climate impacts more pronounced. We cannot ignore the near-term risks of people not getting energy they need—nor can we disregard the long-term risks of climate change as we advocate for a sustainable global economy. We need to make space for both.

Stay grounded in our values: Given the complex and morally charged nature of many of these issues, no single stakeholder has all the answers. As a faith-based investor, Wespath seeks to practice our core values of mutual respect and stewardship as we look for a path forward. This means listening to a diversity of voices—both within The United Methodist Church, and in the broader world. We must then show integrity by seeking to use our voice to help steer us toward a future that will most benefit those we serve and people all over the planet.

What themes would you like us to cover in future blog posts? Let us know at [email protected]

To receive this chart each week via our Wespath Market Update e-mail, please contact our team at [email protected].

We have updated our website with a new look and made it simple to navigate on any device.

We will continue to add more valuable information and features. Please let us know how we are doing.

P.S. For plan sponsors and plan participants, we have a new look for you too. Check out the Wespath Benefits and Investments website.