By Joe Halwax, CAIA, CIMA

Managing Director, Institutional Investment Services

December 19, 2022

Another year has flown by, and for investors it is one that many would like to forget. Stocks opened 2022 on a high note, with the S&P 500 closing at an all-time high of 4796 on the first trading day of the year. After that, it feels like we have been in a constant meat grinder as the reality of inflation kicked in—namely the belief that interest rates would have to rise very quickly to slow economic growth. The whipsaw started in January, with U.S. stocks down 11.5% for the month at one point on Jan 24 before closing the month down 5.3%.

The S&P 500 hit its 2022 low in early October, closing at 3577—roughly a 25% drop from the beginning of the year. As noted in several Wespath publications, the bond market is suffering its worst year since 1788 and may well post double digit losses on the year. 60/40 balanced portfolios were down 20% at various times throughout year, fraying the nerves of the most patient investors.

But let’s consider some positives. One year ago, Omicron was running rampant, and we were all cancelling holiday celebrations for the second year in a row. It was not until spring of 2022 when it felt like the world returned to the most normal that we have seen since early 2020. This year, we will hopefully get a needed break from what has been a volatile year and spend the holidays celebrating with our loved ones in person again.

Whether you’re already getting a jumpstart on your 2023 goals or just trying to make it through the last couple work weeks of the year, here are some of my reflections from 2022 and recommendations for 2023—investments related and otherwise.

While I’m sure my daughters have known about this for years, I just learned you can share a Spotify playlist via text. In trying to get into the holiday spirit, I asked my friends for their recommendations. One friend sent over the “Christmas Instrumental Mix” on Spotify. It is a fantastic mix of holiday tunes, heavy on piano and with a dabble of jazz and horns. I would recommend it to anyone looking for some background music as you work, cook, or wrap some last-minute gifts!

For those of you with New Year’s resolutions and exciting plans for the coming months, I hope you hit the ground running. If a health-centric goal is on your list of resolutions, consider adding some accountability or friendly competition into your routine. At Wespath, we partner with Virgin Pulse, and the number of steps we take can be tracked daily. Everyone has the option to join a team of colleagues monthly, and at the end of the month you can see how your team ranked amongst all others and how your individual steps compare. Knowing your team is depending on you can make it much easier to get up and move.

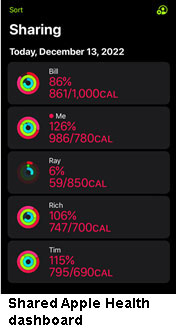

Also, did you know that an Apple watch lets you share data with your friends? Here is a snapshot of me with 4 college friends. Nothing like a friendly rivalry to motivate you to hit your daily goals. Clearly my buddy Ray needs to get moving today!

As the leaves started to turn a golden hue, we turned to warm crockpot meals and hearty soups. At Wespath we had a chili cookoff amongst the members of our investments team. The results were close, but Trent Sparrow, Manager of Impact Investments, won with his beef and spicy sausage chili recipe.

On the topic of food, at another office potluck our very own Kate Tallo brought in her “dirt cake” recipe. While it sounds like something her two-year-old son may have created out in the yard using a shovel and bucket, it is in fact a delicious dessert. It is easy to make and a crowd-pleaser for adults and kids alike should you need a last-minute dessert for an upcoming holiday gathering. I’ve included the recipe at the end of this blog.

Now back to investments… Let’s start with a question frequently asked by our participants and investors: How do you stay informed on the markets and economy? Now is the perfect time to add new podcasts, blogs, webpages or email distributions to your life (and get rid of those that have become stale) as investment resources. Here are some I hope you find useful—perhaps some will become your favorites as well!

Market Research and Insights

As many of you know, the Wespath funds primarily invest in strategies managed by industry leading asset managers. Oftentimes these asset managers conduct and publish high-quality research and insights. While some of this content is published behind paywalls or exclusively for clients, there are still several manager-produced materials that I encourage you to check out.

Two of our asset manager partners—J.P. Morgan Asset Management and BlackRock—publish informative weekly resources, which we in turn share in our “Wespath Market Update” email each Monday. J.P. Morgan’s summary is my go-to “quick take” and first read of the week. Here is an example. BlackRock’s weekly commentary goes more in-depth on one or several timely topics. You can find the latest version here. Alongside these publications, this email also includes updates from Wespath investment staff.

To receive this email distribution, just send us a note at [email protected].

Podcasts

It may come as no surprise that we have several “podcast nerds” here at Wespath, myself included. Our CIO Dave Zellner and I both shamelessly talk about our favorite podcasts frequently, and we don’t hesitate to disagree with those we feel miss the mark. Here are a few of my personal favorites:

Other Online Resource Available to You

At less than $4 a month, one of the best memberships you can buy is a digital subscription to The Wall Street Journal.* For the equivalent of one Starbucks grande cold brew, you get a subscription that offers about 20 different push notice alerts that you can subscribe to, covering news, markets and politics. There are also roughly 40 newsletters—basically, they break the entire paper down into pieces and allow you to subscribe to the newsletter version of those you find most useful, while also providing a link to the full digital edition of the paper. It is very convenient to have exactly what you want sliced and diced.

Investment Team member Fred Huang also recommended the website Seeking Alpha, where you can look up the broad markets, but also follow your top stocks, indexes, and even favorite authors.

Lastly, my colleague Evan Witkowski suggested Morgan Housel’s blog, available here. Morgan is the author of The Psychology of Money and has great insights on the emotions of investing in his weekly blogs.

Twitter Accounts to Follow

I considered dropping Twitter in this year’s blog because Twitter can be... exhausting. In a perfect Twitter world these are the people I would follow, in no particular order:

Of course, all the opinions of these Twitter users are their own, and your mileage with them may vary. Once you start to follow these FinTwit-type accounts, Twitter’s algorithm will start to recommend others, and, with a bit of trial and error, you’ll be able to create a timeline that you find informative.

Another Platform to Consider

Substack–This platform is for independent writers and podcasters, allowing them to publish their content and directly share with their audiences and get paid through a subscription model. Some say that without big media editors it can be unpredictable, but there is also the belief they are less conflicted. Here are a couple to consider:

I hope you enjoy at least a few of these recommendations – have a happy New Year!

Equipment

Ingredients

Instructions

* Price is reflective of WSJ flash sale active at the time of publishing, at $1 per week for 1 year. Standard WSJ pricing is $9.75 per week.

What themes would you like us to cover in future blog posts? Let us know at [email protected]

To receive this chart each week via our Wespath Market Update e-mail, please contact our team at [email protected].

We have updated our website with a new look and made it simple to navigate on any device.

We will continue to add more valuable information and features. Please let us know how we are doing.

P.S. For plan sponsors and plan participants, we have a new look for you too. Check out the Wespath Benefits and Investments website.