From Elation to Misery—How Emotions Tempt Investors to Time the Markets

By Karen Manczko

Director, Institutional Relationships

November 14, 2022

Tis the season for Black Friday sales and holiday markdowns. Many of us will excitedly fill our carts physically or digitally, hoping to snag the best deals. It reminds me of an article I recently read in which the author compared the current market sell-off to a store’s markdown sale1. While typically, like on Black Friday, we would pile up the sale items, investors are not quite as excited when sale items are the stocks and bonds in their portfolios.

So why is it that investors are still ditching their long-term investment strategy, rather than viewing the downturn as an opportunity to buy low? It may be that due to the high rates environment, short-term investments—such as one-year U.S. Treasury Bills paying an interest rate of 4.6%—present a unique opportunity today, giving investors more to think about.

Investors may be enamored by these short-term strategies in the moment, and consider selling long-term investments now and waiting for the markets to “hit bottom” before “getting back in.” But back to the Black Friday analogy, we don’t actually know for certain if that day’s prices truly present the lowest of the low, or if prices might drop even lower on Cyber Monday? Just as there is no way to predict when retail prices will be at their lowest, investors cannot look into a crystal ball to know when the market will reach its lowest point.

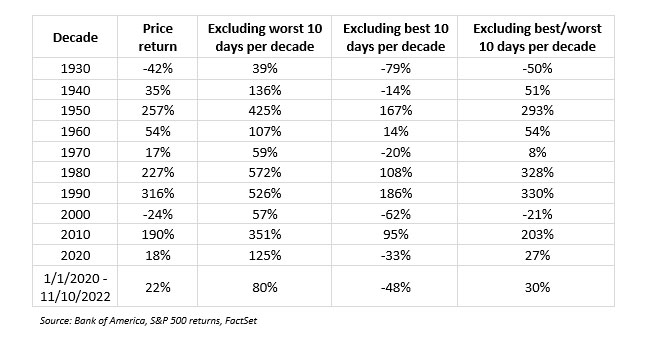

The following chart highlights market cycles, showcasing how difficult it is to time the markets. Looking at the data back to 1930, if an investor did not participate in the S&P 500’s 10 best days for the decade, the returns would be substantially lower than those investors that remained invested the whole time2.

Lest we forget the days of 2020—when we were all baking banana bread and making do with makeshift virtual home set ups—the U.S. equity market declined 34% in just 16 trading days! This loss was followed by a 70% gain through the remainder of 2020, with the S&P 500 ending the year returning +18% for the year. The market continued its upward trajectory into 2021, causing investors a continued sense of elation resulting from their portfolio gains. As investors with long-term return objectives, we have to endure difficult emotional markets lows in order to also benefit from these euphoric rallies.

While current conditions may not closely resemble 2020’s market narrative, we must remember as long-term investors that we don’t know when the markets will reverse course, but we know if we adhere to our disciplined approach to investing we will reap the reward when the time comes.

1https://www.cnbc.com/2022/08/01/why-americans-are-wrong-to-keep-cash-out-of-a-volatile-stock-market.html

2https://www.cnbc.com/2021/03/24/this-chart-shows-why-investors-should-never-try-to-time-the-stock-market.html