Dude, Where’s My Peloton?

By Joe Halwax, CAIA, CIMA

Managing Director, Institutional Investment Services

March 14, 2022

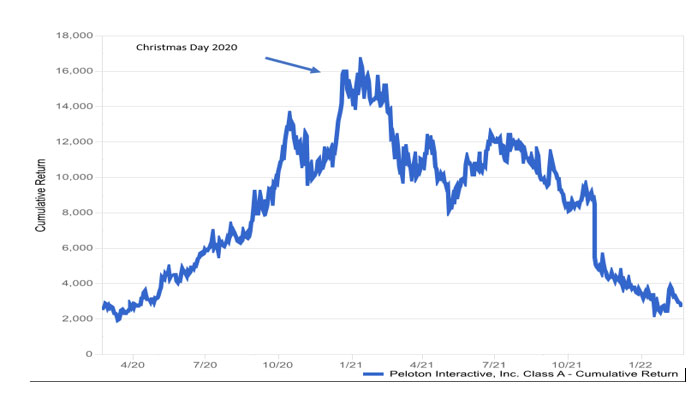

Last week my neighbor sold her Peloton on Facebook Marketplace for $950—quite a haircut on the $2,500 she purchased it for back in February 2020. If she had instead used the $2,500 to buy Peloton stock on February 23, 2020, she could have sold it on December 24, 2020—right in time for the panicked Christmas rush—for $15,969 (a 500%+ return) and bought her three kids A LOT of Legos! On the flip slide, had she waited and sold said hypothetical stock on February 23, 2022 (two years later), it would have been worth $2,648 (a 6% return).

Peloton is not alone. The last two years have been a whirlwind for many stocks. While COVID-19 will always be one of the strangest and scariest times in my life for health reasons, including those related to mental health, it was also one of the most wild and unchartered times for U.S. equity markets.

At Wespath we are long-term investors—we stay the course in lieu of chasing fads, jumping at the latest investment trend and trying to time the markets. Our disciplined investment approach accepts that there are times when markets become dislocated, where illogical trends may emerge and even take off. Throughout, we eschew market noise and remain focused on our long-term investment vision. In the 1930s, economist John Maynard Keynes noted, "Markets can stay irrational longer than you can stay solvent." That is to say it is nearly impossible to predict the markets and those who try, may find themselves in over their head. Over the last two years we have seen many examples.

Remember GameStop and Robinhood? Early last year I wrote about the 2021 frenzied trading of GameStop, which was largely influenced by social media and driven by retail traders using the Robinhood platform and Reddit channel "WallStreetBets." For several months the spotlight was theirs, with the media framing the phenomena as a "David versus Goliath" story—the small retail investor underdogs taking on the mighty hedge funds. A year later, it’s clear this was just another short-term pandemic phenomena, all but forgotten.

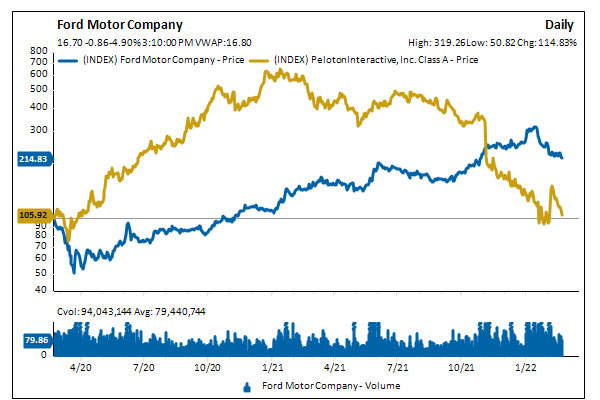

Peloton’s stock rose over 500% in 2020, to a market cap of $42 billion at the end of the year. In February-March 2020 Ford Motor Company’s stock was cut in half over six weeks from roughly $8 to $4. By December 2020, the stock had recovered to just under $9, with a market cap of $36 billion. We closed 2020 with Peloton at a higher market cap than Ford by roughly $6 billion. These are just several examples of the irrational market activity influenced by the unprecedented working and living conditions of early pandemic days.

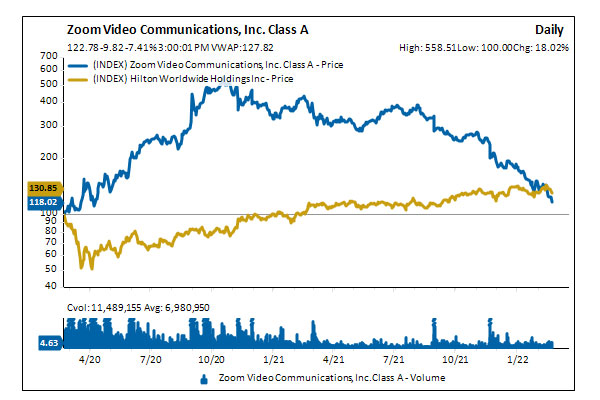

One of my favorite podcasters, NYU professor Scott Galloway from the “Prof G Show,” recently posted a clip with a similar comparison of Zoom and Hilton . 1At the onset of the pandemic, Hilton fell 48%, similar to Ford, while Zoom peaked at nearly 450%. The pandemic narrative was that travel was on an extended hold, and remote work was fundamentally changing the way we worked. By February 2022, the pandemic had played out and markets had reverted to pricing based on fundamentals—Hilton had gained 33% since February 2020, outperforming Zoom, that had gained only 20% from pre-pandemic levels.

Since early 2020 these stock stories have dominated headlines and captivated investors. Their 15-minutes of stock market fame, however, had a much larger impact on CNBC airtime than actual market activity.

Long-term investors like Wespath, however, wait out market volatility and remain invested in stocks. We are confident that our investment approach is prudent and will continue to serve our investors. That being said, there are still quite a few hard-to-resist deals for Peloton bikes on Facebook Marketplace— might be time to clear some room for one in the basement!

1 https://www.youtube.com/watch?v=VXWV4TEorbU