How Alternative Investments Can Benefit Your Diversified Portfolio

By Amy Bulger

Director, Private Markets

March 7, 2022

Most investors share the same basic goal: to build a diversified investment portfolio that will achieve their unique financial objectives. Investors often seek to accomplish this goal by allocating to publicly traded stocks and bonds, which serve as the foundation of countless portfolios. In fact, many investors continue to adhere to the classic "60/40 portfolio"—investing 60% of their portfolio's assets in stocks and 40% in bonds. Nevertheless, the 60/40 strategy has evolved, and investors are increasingly seeking new ways to diversify their holdings and achieve stronger long-term risk-adjusted returns.

One approach that has grown popular is adding alternative investment exposure to a traditional stock and bond portfolio. In very broad terms, alternative investments, sometimes just called "alternatives" or "alts," can include any investment or strategy that is not one of the three primary asset classes—stocks, bonds or cash. Examples of specific asset classes within this broad category include private market investments such as private equity, private real estate and private credit; real assets such as land, precious metals and natural resources; and hedge funds.

Generally, alternatives are not traded on public exchanges, and compared to stocks and bonds, they tend to be relatively illiquid, or more difficult to buy and sell. For these reasons, alternative investments typically attract more sophisticated investors. With that said, alternatives do offer some compelling benefits and may support investor portfolios for several key reasons:

Potential for Higher Returns

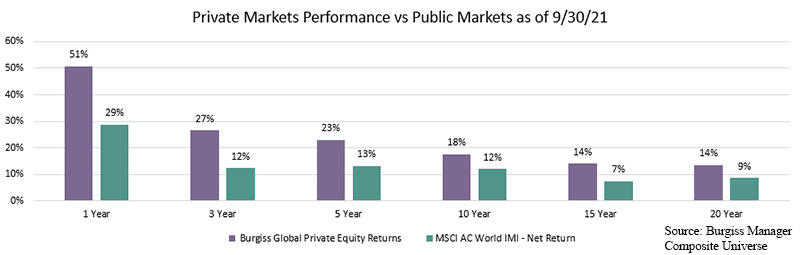

Investing in alternatives expands one's potential investment universe, creating more opportunities to capitalize on market inefficiencies and improve returns. For example, long-term global private equity returns compare favorably to their public market counterparts:

Potential to Improve Portfolio Risk/Return Characteristics

Adding alternatives to a portfolio typically provides enhanced diversification. You know the saying: Don't put all your eggs in one basket. That's what investors avoid when they diversify. Each asset class has unique characteristics, and their prices react differently to market news, economic conditions and changes to business cycles. Combining asset classes in a diversified portfolio at appropriate allocations creates the benefit of reducing expected risk.

For example, private real estate investments, such as commercial or residential buildings, are valued independently of public stock indexes. The factors that affect the value of publicly traded stocks may not affect the value of real estate; these two asset classes may even move in opposite directions based on the same news or conditions. Hence, real estate can serve as an important diversifier in a traditional portfolio of publicly traded stocks.

Other Things to Consider

Though alternatives do create the potential for better risk-adjusted returns, investors should be aware of additional risk considerations.

For one, alternative investments are a highly specialized asset class that requires additional operational resources, investment expertise and industry relationships to be successful. Organizations that seek alternatives for their institutional portfolios should expect to spend more time on sourcing and monitoring investments. They may even need to commit to longer time horizons, as some private funds average a lifespan of seven to 10 years or longer.

Alternative investments also tend to incur higher fees. For example, annual management fees typically range from 1% – 2% and there is usually an additional "incentive" fee of 10% – 20%, paid when performance exceeds a predetermined hurdle. While the net-of-fees returns may ultimately justify these higher fees, investors should be prepared to pay asset managers more compared to funds composed of stocks and bonds.

Wespath's Approach

The Wespath funds make modest allocations to alternative investments—including private equity, private real estate, private credit and real assets—within their broader equity and fixed income funds. We believe the prudent sizing of these allocations, typically less than 10% of the entire fund, provides the opportunity to enhance returns without significantly increasing fund fees, while slightly reducing the risk of the overall funds.