By Chirag Acharya

Analyst, Sustainable Investment Stewardship

December 20, 2021

COVID-19 vaccine equity is a salient issue to prudent investors due to the risks associated with vaccine inequity. Nearly a year after the initial rollout of COVID-19 vaccines, doses are readily available in the U.S. and much of the developed world. However, a serious gulf in vaccine distribution rates has emerged in many countries around the world, and amid the spread of the Omicron variant, the social, ethical and economic importance of addressing this gap has grown ever-more heightened.

Here at Wespath, we believe that COVID-19 vaccine inequity poses a risk to our vision for a sustainable global economy, which promotes social cohesion, long-term prosperity for all and environmental health. As we've shared before,1 we think a sustainable economy will deliver healthier financial markets and greater financial security for Wespath's stakeholders.

So, what exactly is the issue? For one, the Centers for Disease Control and Prevention (CDC) acknowledges the disparity in COVID-19 vaccine equity for racial and ethnic minority groups in the United States.2 This disparity is also seen around the globe, with the lack of equitable access to vaccines to people of all races exacerbating the issue of racial equity.

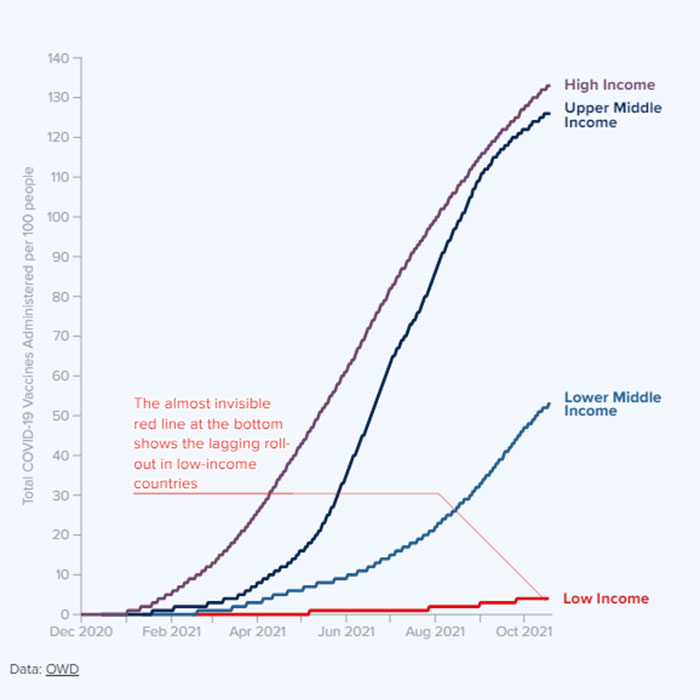

As an example, just over 10% of individuals in Africa are fully vaccinated,3 while approximately 60% of the U.S. population is fully vaccinated.4 This trend is mirrored around the world, with large discrepancies in the number of vaccine doses administered across economic divides. This is illustrated in the chart below, where countries are categorized as "High Income," "Upper Middle Income," "Lower Middle Income" and "Low Income."5

Low vaccination rates in African countries are due to weak distribution supply chains, including lack of supplies required to administer vaccines and refrigeration units to properly store the vaccine; healthcare systems with limited capacity; and vaccine hesitancy.6 Another factor is that COVID-19 vaccine research and development has largely occurred in developed economies, which has led to many developed nations stockpiling vaccines.

Developed countries have also been slow to recognize a moral imperative to distribute COVID-19 vaccines to less fortunate countries. According to Airfinity, a global health intelligence company, by year-end there will be a surplus of 1.2 billion vaccine doses in developed countries, which would be enough to meet a key goal for this year set by the World Health Organization (WHO) of vaccinating at least 40% of people in lower-income countries—and only half of the surplus will be donated to other countries.7 In the words of the WHO, "The global failure to share vaccines equitably is taking its toll on some of the world's poorest and most vulnerable people."8

This failure to share and distribute vaccines has contributed to the struggles of COVAX, a WHO-led initiative designed to coordinate resources to fight COVID-19 in low- and middle-income countries. The COVAX initiative pledged to deliver 2 billion COVID-19 vaccine doses in 2021 to individuals in these countries but has thus far fallen short of its goal.9

Costs associated with COVID-19 vaccines are an important factor. The average cost paid per COVID-19 vaccine ranges from US$2 to $40, while the estimated distribution cost is about US$3.70. This is an incredible financial burden for low-income countries, where average annual per capita health expenditures amount to just US$41.10

Equitable vaccine distribution is integral for many reasons, including its effect on the continued prevalence of COVID-19. For one, the CDC has stated that global access to COVID-19 vaccines can help prevent new variants of the virus from emerging.11

The equitable distribution of vaccines also has clear economic implications. For example, pandemic-related trends have been widely linked to the rise in inflation in the U.S.—in the words of Treasury Secretary Janet Yellen, "The pandemic has been calling the shots for the economy and for inflation. And if we want to get inflation down, I think continuing to make progress against the pandemic is the most important thing we can do."12

A full report on the economic impact of COVID-19 was recently published by the Congressional Research Service.13 It discusses inflationary pressures and the pandemic's effect on the domestic economy, global trade, economic forecasts and much more; it's a long read, but it helps illustrate the scale of the pandemic's economic consequences.

Crucially, we're also seeing variability in economic recoveries resulting from inequitable vaccine distribution. For instance, countries with higher vaccination rates are likely to reopen their economies more quickly, while those with lower vaccination rates may opt for extended lockdown measures. Based on this and other factors, analysis from the United Nations Development Programme (UNDP) concluded that "the economic recovery rate is predicted to be faster for countries with higher vaccination rates, with about US$7.93 billion increase in global GDP for every million people vaccinated."14

There are socioeconomic factors to consider as well. For instance, the COVID-19 pandemic has led to a surge in opioid-linked substance abuse and deaths in the U.S. The CDC has stated that 100,000 people died of drug overdoses in the U.S. during the 12-month period ending in April 2021, which was up over 28% year over year.15

As a fiduciary, Wespath must carefully address and manage issues that pose clear financial risks. We acknowledge that a prolonged pandemic and an inequitable response to COVID-19, and subsequent economic and societal challenges, may have a negative impact on companies in which we invest and our ability to achieve a sustainable global economy. This is why we endorsed the Access to Medicine Foundation's global investor statement on COVID-19, which issued a joint call from 150 institutional investors for a fair, effective and equitable global response to the pandemic. This statement included a request for countries to fully fund the ACT Accelerator, a multi-stakeholder partnership dedicated to developing, producing and ensuring equitable access to COVID-19 tools.

Wespath believes that collaborative initiatives like the ACT Accelerator can be part of the solution. We have also engaged with pharmaceutical companies involved in the production of COVID-19 vaccines regarding their commitments to meet vaccine demand. We will continue to work with our peers and external asset managers to find ways that our stewardship work can support vaccine equity. This engagement with pharmaceutical companies builds on our long-standing commitment through the Investors for Opioid and Pharmaceutical Accountability (IOPA) to address the opioid crisis which the pandemic has exacerbated.

Finally, we understand that the issue of vaccine equity is important to our stakeholders in the United Methodist (UM) community. The Connectional Table, a UM leadership body, declared COVID-19 vaccine distribution a "missional priority" and called on United Methodists to help increase vaccination rates in their communities and globally. Wespath continues to support this cause and looks forward to collaborating with fellow UM organizations to help end the pandemic.

1 https://www.wespath.com/Investor-Resources/Blog/0001

2 https://www.cdc.gov/coronavirus/2019-ncov/community/health-equity/vaccine-equity.html

4 https://usafacts.org/visualizations/covid-vaccine-tracker-states/

5 https://data.undp.org/vaccine-equity/

6 https://www.cbc.ca/news/world/vaccine-inequity-covid-19-africa-1.6275262

8 https://www.who.int/campaigns/vaccine-equity

10 https://data.undp.org/vaccine-equity/

11 https://www.cdc.gov/coronavirus/2019-ncov/vaccines/facts.html

13 https://sgp.fas.org/crs/row/R46270.pdf

14 https://data.undp.org/vaccine-equity/impact-of-vaccine-inequity-on-economic-recovery/

15 https://www.cdc.gov/nchs/pressroom/nchs_press_releases/2021/20211117.htm

What themes would you like us to cover in future blog posts? Let us know at [email protected]

To receive this chart each week via our Wespath Market Update e-mail, please contact our team at [email protected].

We have updated our website with a new look and made it simple to navigate on any device.

We will continue to add more valuable information and features. Please let us know how we are doing.

P.S. For plan sponsors and plan participants, we have a new look for you too. Check out the Wespath Benefits and Investments website.