Value Investing Isn't Dead, It Just Needs Redefining

By Trish Halper, CFA

Deputy Chief Investment Officer

February 5, 2021

As I reflect on last year's market performance, I cannot help but notice that, despite all of the new things that happened in 2020, one of the most prevalent themes was the familiar debate around growth vs. value investing.

For the uninitiated, "growth" and "value" are terms used to categorize stocks based on fundamental company metrics. Generally, growth stocks are expected to see growth—measured by sales and earnings (profit) growth—at a higher-than-average rate compared to the overall market. These types of companies often do not pay dividends.

Value stocks, on the other hand, are generally less expensive—measured by common company valuation ratios—but slower growing than the overall market. Typically, their dividend yields are higher than average. Value investors are wary of "overpaying" for certain stocks based on current company financials.

The growth vs. value debate has raged for years, and there is no shortage of research on the topic. A quick Google search for "Value underperforming growth" yields almost 4 million results. Conversations range from analysis papers on value factors and near/long-term performance, to takes on the "death" and potential "resurrection" of value.

In reality most investors I know are not in the "either-or" camp—they prefer a blend. At Wespath, we are "style neutral," meaning we position our balanced strategy to have the same growth and value exposure as the overall market.

For the purposes of this reflection, I look to style indexes created by FTSE Russell. The company uses metrics and ratios to determine if stocks are value or growth. These categories are not mutually exclusive—a company can have value and growth characteristics and be included in both types of indexes, but FTSE Russell adjusts the weighting, or amount of the stock included in the index, to reflect a style preference.

FTSE Russell uses the price-to-book ratio as its proxy for value. This measures the market's valuation of a company relative to its book value, also known as its balance sheet value. Generally, a price-book ratio under 1 is considered an attractive valuation. For growth, the index maker uses a combination of forecasted earnings growth—which considers consensus estimates for the next two years—and sales growth, which is based on historical sales over the last five years.

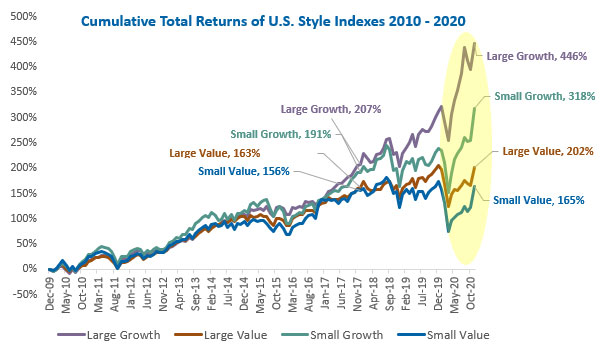

Here's a look at cumulative returns of value vs. growth—broken down further by large-cap and small-cap size classifications—in the U.S. markets, according to FTSE Russell, since the Great Financial Crisis:

We see now why some investors have talked about the death of value! This chart shows a large spread between the performance of growth stocks and value stocks. We see that this trend was in place a few years ago, but it has really blown out recently. In fact, we can pretty much say that the spread between growth and value performance in the U.S. is wider than it has been in the last decade.

So what's causing this gap in performance? Many argue that the preference for growth stocks in the most recent time reflects investor preference for profitable technology stocks leading a global technology revolution and benefiting from near-zero interest rates. That may well be true.

But to me, that does not mean value is "dead." In fact, I think the issue is really centered on the need to consider value through a more modern lens, breaking the traditional molds of the past.

Consider again FTSE Russell's metric of choice for value stocks: price-to-book ratio. Is this still the right measure to use?

I think as the U.S. continues to shift from a manufacturing economy to a service economy, price-to-book becomes less relevant as a valuation factor. The intangible assets of service companies—their brand recognition, research and development, and intellectual property—add to shareholder value in ways that are not always captured in a traditional price-to-book measure.

Today's value investors need to focus on combining metrics like free cash flow yield and forward price-to-earnings, with profitability factors like asset turnover and return on invested capital, especially in service sectors with high intangible assets.